...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

These are not the best of times for investors and shareholders of BUA Foods, a subsidiary of BUA Group owned by Nigerian billionaire, Abdul Samad Rabiu, as the shares of the company dipped drastically on Monday following trading hours in the Nigerian bourse (Nigerian Exchange Limited.

The development has also affected the fortunes of the company’s chairman, Rabiu, as his wealth dwindled by -0.44%.

According to a report by Ripples Nigeria, BUA Foods’ stock slumped in value by -1.45% hours after report emerged that the company won’t be joining Dangote Sugar and Flour Mills of Nigeria (FMN) to allegedly increase cost of sugar through scarcity, as Ramadan approaches.

The company had accused Dangote Sugar and FMN of suspension of sugar sales on Monday, in an effort to profit on the rise in demand of sugar during the Muslim festive period in six weeks time.

BUA Foods stated in the statement reported by a newspaper that it won’t be joining in the artificial scarcity, and at the end of trading hours, the capital market rewarded the accused companies, and reacted negatively to Abdulsamad’s company.

Following the allegation, analysis of market trading between the three biggest sugar producers showed that Dangote Sugar’s share appreciated by +1.70%, while FMN’s shareholders investment grew by +3.56%.

BUA Foods wasn’t so lucky, as a negative outlook knocked shareholders’ investment down by -1.45%, losing N16.2 billion, after trading flat most of last week, when it also shed -4.03% in value. Investors and shareholders of the company have continued to lament over the situation.

Monday’s loss in BUA Foods led to Abdulsamad losing N12.47 billion ($30 million) from his fortune, which represents -0.44% of his wealrh – he’s now worth $6.8 billion.

During the same period, Aliko Dangote made N2.49 billion ($6 million), and his wealth is now estimated at $14.1 billion.

The food businesses recently merged into BUA Foods by the BUA Group were BUA Sugar Refinery Limited, BUA Rice Limited, BUA Oil Mills Limited, IRS Flour, and IRS Pasta

BUA’s ex-staff cries out over alleged non-payment of entitlements

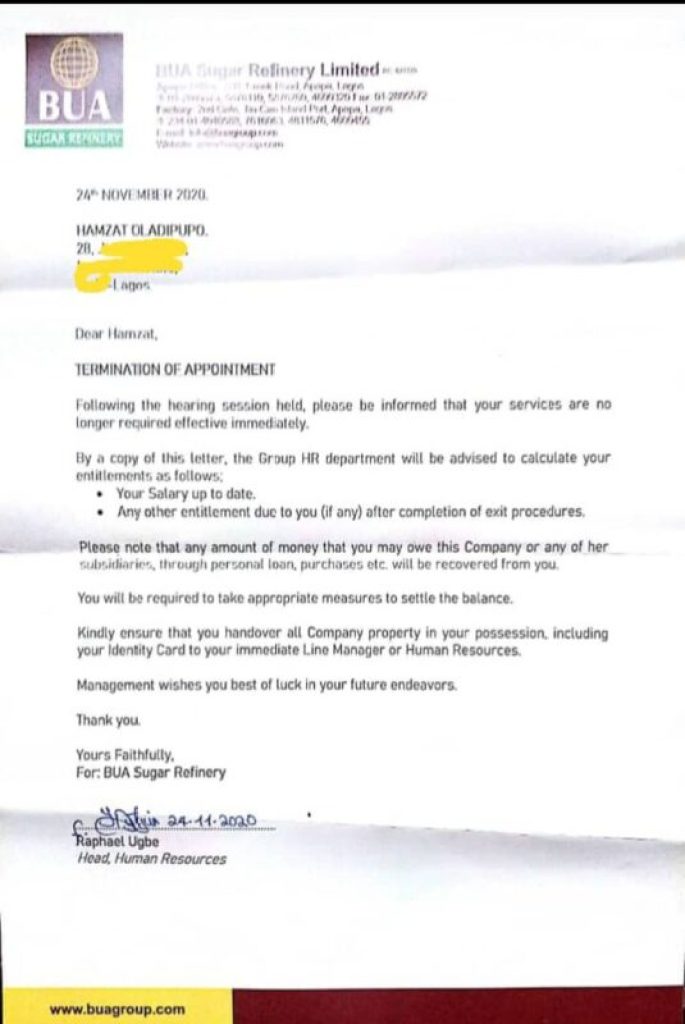

Meanwhile, a Nigerian man, Hamzat Oladipupo, who once worked for BUA Sugar Refinery Limited has called on Nigerians to appeal to the management of the company and founder, Rabiu over the alleged non-payment of his entitlement since the termination of his appointment in November 2020.

Hamzat, in a tweet on Monday, explained that he worked for the company as a civil engineer for more than 14 years before the termination of his appointment in 2020.

According to him, the company, however, refused to pay him the termination benefits he is entitled to as stipulated in the company’s handbook for staff.

Hamzat further explained that he got in touch with the company requesting the payment of his termination benefits and was promised the payment would be made.

He said one Dotun Adako, who he claimed is the Head of Human Resources Department for BUA Group assured him that the payment would be made in 2021, directing him to the company’s refinery at Apapa, Lagos.

However, Hamzat said Adako’s assistant in the Apapa office claimed he had no idea of such an arrangement.

This, according to him, shows that the BUA is not willing to pay him his entitlement as he also claimed that other staff members who left after him have the same complaints.

He wrote on Twitter, “Nigerians Please Help Me Appeal To BUA Group And Mr Abdul-Samad Rabiu (Chairman BUA Group) To Pay My Terminal Benefit Since November 2020.

“I am Hamzat, who worked for BUA Sugar refinery for 14 & half years (2yrs of project inclusive) as Civil Engineer handling multiple tasks from design to construction. I used to solely handle Arch, Str, BOQ prep & manage d construction without even an IT student in my last 8yrs.

“I was disengaged in Nov 2020 and BUA has refused to pay me d promised terminal benefits dt is stated in workers handbook. “Mr Dotun Adaeko (BUA grp hd of HR) promised my payment will b early 2021 so I should b relating with his assistance at d Apapa refinery.

“The Apapa office has no clue on getting my pay ready as Mr Dotun also no longer picks my calls nor responds to my mails and thus BUA is showing serious unwillingness to pay me.

“Also I have written to Mr Abdul Samad severally and my mail was not once responded to.

“Honourable Nigerians please help me request my entitlements from BUA who is more than capable of paying my money but wouldn’t want to.

“Also some other colleagues that left after me told me that they are suffering the same condition.

“Nigerians please help me to get my terminal benefits as I have done my very best of contribution to contribute to the growth of BUA Sugar refinery so I should be paid my dues.

“Nigerians please help appeal to Mr Abdul Samad Rabiu to pay my due. Please help.”

O’tega Ogra, group head, Corporate Communications, BUA Group, did not respond to inquiries as at press time.

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)