News and Report

BEHOLD THE NEXT OONI OF IFE….. + All you need to know about Prince Adeyeye Enitan Ogunwusi

Published

8 years agoon

They say the sun will rise and set, seasons will change their turns, and the youth will take over the old. The hourglass has been flipped, the king has gone to meet his ancestors and for Prince Adeyeye Enitan Ogunwusi it is only the beginning. Take notice, for his time has come.

Since the demise of the highly dignified Oba Okunade Sijuwade, Olubuse II, who in his capacity as the Oonirisa of the source brought a lot of fanfare and prestige to the already well revered stool that at one time or the other had been occupied by such illustrious personalities as Oduduwa & Oranmiyan, the race for the next Ooni has been on and the four ruling families; Osinkola, Ogboru, Giesi and Lafogido are now contenders.

A declaration document was signed by then Chairman of Chieftaincy Committee of Oranmiyan Local Government; P. O. Olaniyi. The document, which was forwarded for approval on September 14, 1979 and was signed on January 28, 1980 approving the rotation of the stool among the 4 ruling houses, in that order. The document had been prepared under the reign of the late Oba Adesoji Aderemi who was from the Oshikola ruling family. The late Oba Okunade Sijuwade, the Olubuse II, being a product of the Ogboru ruling house, the next in line to ascend the throne must therefore come from the Giesi family. The Prince of the source, a fearless and self-made business man, Prince Adeyeye Enitan Ogunwusi, being the 4th direct descendant of the Giesi family, is in all context, the man for the throne.

About forty years ago in the ancient city of Ile-Ife, a prince was born into the Giesi Ruling House, Ojaja Royal Compound of Agbedegbede in Ile-Ife. He was named Adeyeye. Prince Adeyeye Enitan Ogunwusi was quietly delivered into the humble family of Prince Ropo and Late Mrs Margaret Wuraola Ogunwusi (Ile Opa family compound, Ile Ife). The father was a radio and television anchor and presentation star that spanned the entire mid-1980s to early 21st century in the South-western part of Nigeria. Though born quietly, Prince Ogunwusi’s excellence and outstanding acumen would soon start to announce itself for the world to behold.

An astute entrepreneur, driven by turning ‘impossibilities to possibilities’, Adeyeye’s power of imagination has set him aside, revolutionizing his approach to creativity and innovation. A distinct achiever, with the conscience of youthful excellence, his ambition is exceptional with savvy business ideas, making a mark in his immediate society and beyond.

He has been involved in Engineering, Procurement and Construction (EPC) locally and abroad for over 12 years and he is also actively involved in the development of over 2,500 housing units with various consortia of developers/promoters over the last 8 years in Nigeria. He facilitated strong trade relationship through Association for International Business (AIB) with presence in over 200 member countries across the globe which he set up in Nigeria. One of the key achievements of this body is the trade facilitation between the United Arab Emirates (Jebel Ali free Trade Zone development) and Federal Government of Nigeria through Nigerian Investment Promotion Commission (NIPC). He was a co-organizer for Ondo State Economic Planning and Implementation Committee. He led the Government delegation team to Canada in 2002 for strategic alliances and partnership with Ondo State Government on solid mineral potentials of the State (Bitumen, Dimension Stones, Granite, etc.) which led to the formation of Amalgamated Mining and Exploration Company Limited – wholly owned by Ondo State Government. He was involved in the facilitation and development of Sparkwest Steel Galvanizing Plant (the only Steel Galvanizing Plant in Nigeria), National Iron Ore Mining Company Limited and Jakura Mines resuscitation projects, which has eventually become the major limestone feed stock to Obajana Cement Plant in Kogi State, Nigeria.

Prince Adeyeye Enitan Ogunwusi was involved with trading and marketing of commodities, the main facilitator for Dangote Group’s break into the ‘up-country supply chain consortium’ between 1996 and 1999. He also traded for Dohagro Allied, Global Apex, Olam, Clemco, Stallion Group, Milan Group etc, at about the same period. This is where he gained expertise in marketing prowess which up till date is one of his major strengths. He also facilitated the biggest Lead and Aluminum recycling plant set up in Nigeria by National Steel Company of India in Ota, Ogun State.

He began his strides in the Real Estate sector with various dredging and land reclamation projects in Lagos State. Adeyeye is the initiator of EssentialHomes, a real estate product launched in January 2014 formed to deliver affordable upscale homes to the middle and low income earners. The 1st phase of the product (The Southpointe Estate, Lafiaji Road, Lekki, Lagos State) started in February 2014, and has been successfully delivered within 1 year with about 60% occupancy recorded. This attests to the huge market demand and acceptability of the EssentialHomes product. He also led the team that developed the beautiful Northpointe Estate Phase I,II,III and Midland Court , on Chevron Drive Lekki Lagos. In addition, Prince Adyeye has successfully undertaken more multi-billion Naira projects across Lagos and environs; Jacob Mews Estate Yaba, Lakeview Park I and II Estates Lekki, the ongoing Golden Leaf Estate Lafiaji, Lekki and Grand Lake Estate Ajah, Lagos.

Adeyeye also has clear track record of community development starting with his home town; 4yrs ago during the occasion of his Mum’s funeral, the community was without any form of electricity. Adeyeye went ahead to install transformers and light poles, generated electricity which till today, the community still boasts of. This electrification project is also being extended to other parts of the town. Part of his community development strides has also extended to the Lafiaji community, off Orchid Hotel road, Lekki-Epe expressway, Lagos, with the opening up and reconstruction of a 6.5km road, with a 1.1km green extension without Government intervention. He also embarked on the electrification of this whole stretch which is being powered by his company, Gran Imperio Group.

In just 1 year, to actualize his dream of the development of one of the best resorts in Nigeria, he led a team that opened up a remote jungle, Inagbe Island, Amuwo Odofin LGA, Lagos, into a whole new community offering spectacular world class relaxation and recreational facilities. The multi-billion Naira Inagbe Grand Resorts and Leisure, Lagos Nigeria is a first of its kind in the whole of West Africa bounded by the Lagoon and Atlantic Ocean. With this feat, he is set to increase the country’s GDP through tourism and reduce unemployment by providing direct and indirect employment. At the launch of this magnificent project in December 2013, The Managing Director of First Bank Plc., Mr. Bisi Onasanya, told The Nation Newspaper (published on December 13 2013) that tourism remains a veritable means of entrepreneurship and revenue earner for Nigeria, hence it should be given necessary support. The First Bank boss also said this at the unveiling of the signage of the resort, “It is a shame to some of us that we have waited this long for a younger person to come and wake us up and show us what we are able to do.”

Earlier this year, Prince Adeyeye also intimated the youth of Ile-Ife of his plan to replicate this remarkable project in Ile-Ife, having already acquired good land mass for the project. Interestingly, he has an incredible master plan to rebrand Ife and take it to greater heights. On the 7th of March 2015, Adeyeye was a recipient of the prestigious NIDSA (National Ife Descendants Students’ Association) GOLD AWARD for 2015 on the occasion of their Ife Day celebration.

Prince Adeyeye enjoys being in the midst of his workers, celebrates and dances with them, dines with them, crack jokes and of course gets on the work grind with them. He is a grass root fellow to the core and lover of the youth. His humility is second to none. Being a philanthropist, Adeyeye has sponsored less privileged children and youth in Ile-Ife and Lagos where he lives. Some youth are still beneficiaries of Adeyeye’s scholarship platform till date.

Adeyeye is presently an employer of over 300 indigenous youth at the Inagbe Cocowood Factory – EssentialHomes Furniture brand, first of its kind in Nigeria using 100% indigenous raw materials for production. He has over 450 direct employees across his various companies, and over 3000 indirect employees.

Prince Adeyeye Enitan Ogunwusi is a Director on the Board of Directors of Imperial Homes Mortgage Bank Limited, (formerly GTHomes), a leading National Mortgage Bank and former subsidiary of one of the biggest banks in Africa, GTBank Plc. He is also a Director, FinaTrust Microfinance Bank Limited, one of Nigeria’s foremost Microfinance Banks focusing on SMEs and micro credit facilities. He is the Founder and Managing Director of Gran Imperio Group, the holding company of Real Estate and Construction, Manufacturing, Facilities Management, Leisure and Tourism companies in Nigeria.

Prince Adeyeye Enitan Ogunwusi holds a Higher National Diploma in Accountancy from the Polytechnic Ibadan, where he started cutting his teeth in outstanding entrepreneurship, even as a student. To mention a few, the royal prince of Ile-Ife the source, is a member of dignified professional bodies, namely, Institute of Chartered Accountants of Nigeria (ICAN), an Associate Accounting Technician and a certified member of the Institute of Directors (IoD) Nigeria. He is also an active member of Global Real Estate Institute (GRI), having participated at various levels.

To be a prince in Yoruba land is in itself outstanding. To then be a prince of the source Ile-Ife, the Cradle of Civilization is to be truly blue-blooded. Very passionate about what he believes in; people and possibilities, Adeyeye has achieved giant strides even from his very youthful age.

Prince Adeyeye Enitan Ogunwusi has been involved in remarkable partnerships with dignified Royal Fathers in some of his Real Estate developments; HRM, Oba Saheed Elegushi, Kusenla III, Elegushi of Ikate Land, Lagos (Development of LakeView Park 2, Lafiaji, Off Orchid Hotel Road, Lekki – Epe Expressway), HRM, The Ooni of Ife, Oba Okunade Sijuade, (development of Northpointe Estate, Chevron Drive, Lekki, Lagos), HRM, Oba Oyekan, Onilado, of Ilado Inagbe Island, Lagos, (Development of Inagbe Grand Resorts and Leisure, Lagos), HRM, Oba Adedapo Tejuoso, The Oranmiyan Osile Oke Ona of Egba Land, Abeokuta (development of The Lord’s Estate, Buckswood College Abeokuta), HRM, Oba Oloruntoyin Saliu, the Oloworo of Oworonsoki, Lagos (partners in the proposed Oworonsoki Redevelopment Scheme, Lagos), HRM Oba Akinloye, Ojomu of Ajiran Land, Lekki – a host to several developments which Adeyeye has embarked on, HRM, The Olofa of Offa, Oba Mufutau Muhammed Gbadamosi (partnership during the rice and sugar merchandising for Dangote Group and others).

A highly dignified man, fearless and daring, a self-made man who not only has passion for his home town but his country as a whole, who has and is working in the improvement of the society at large whilst he spends his time and money to preserve and showcase the cultural heritage of his people and tradition of Ile-Ife, he also is creating many job opportunities for the indigenes of Ife.

He is loved and highly respected by the people of Ile-Ife, the Prince is someone who has stayed and is very much in touch with his roots and tradition. A man of honour who already has started making a difference in the city of Ife, He has close alliances with some of the most esteemed Royal fathers, leaders and kings men.

Truly it’s a new dawn and Ife will never remain the same again.

You may like

News and Report

Experts to tackle declining consumer purchase power at 2025 Industry Summit

Published

2 hours agoon

March 11, 2025

Following the Manufacturers Association of Nigeria (MAN) statement in early January 2025 that manufacturing sector in Nigeria recorded unsold goods accumulated to a total of N1.4trillion, which was attributed to inflationary pressures and declining consumer purchasing power, the organisers of The Industry Summit, The Industry Newspaper has designed the sixth edition of the summit to address the consumer preferences in a troubled fast moving consumer goods (FMCG).

Announcing the 2025 theme: “Understanding Changing Consumer Preferences in Troubled FMCG’s Space”, the convener of The Industry Summit & Awards (TIES), Goddie Ofose stated that the dwindling purchasing power of consumers as become one of the major reasons that manufacturing sector declared heavy inventory loss in 2024, and organisations must design innovative approach to tackling this menace in 2025.

According to him, “Inflationary impact is real and it has continued to dig some holes in the pockets of consumers, which in turn results in consumers’ preferences. Manufacturers must adapt to the shifting consumer preferences if they must survive,” he added.

Ofose revealed that the organisers have selected Dr. Obinna Ike, chief executive officer/managing director of NigerBev Limited as the chairman of the event while Mr. Lampe Omoyele, managing director of Nitro 121 Limited will deliver a keynote paper on the theme.

Also lined up as guest speakers are Mrs. Toyin Nnodi, former marketing director of CHI Limited, Mr. Stanley Obi, immediate past Prime Business Director at Grand Oak/Co-founder/CEO of Innova Hive Integrated and Mr. Anthony Eigbe, Vice President, Creative & Communications, UAC Nigeria Plc.

He said, “We have carefully selected the 2025 members of faculty who possess vast experience in product innovation, marketing, advertising, brand management, distribution value chain and communication that would look at these issues dispassionately and proffer solutions to this new market challenge.”

This year’s programme, which is scheduled for Friday, May 2, 2025 for lecture and Saturday, May 3, 2025 for dinner and awards, will also feature a panel session. The panel members include Mr. Ayo Awosika, GM, Commercial, UAC Foods, Mr. Remi Akanda, Director, Marketing & Corporate Communications, LAPO Microfinance Bank, Mr. Adeola Amosun – Group Media Manager, Tolaram, Mr. Gbemileke Lawal, Marketing Manager, Grand Oak Limited, and Ms. Oluseun Mudashiru, Brand Manager- Big Bull Rice, TGI Group.

Others are Mrs. Roseline Abaraonye, Chief Commercial Officer (CCO), N.N. Fems Group, and Mrs. Ifeoluwa Esther Obafemi, Head, Digital, Media & Insights (Digital Transformation), Sub-Saharan Africa (SSA), FrieslandCampina WAMCO while Ms. Gift Uche-Ewule, Assistant Brand Manager, Indomie will the moderate the session.

The 2025 event is a two day programme with lecture taking place at Chartered Institute of Bankers of Nigeria, Victoria Island on Friday May 2 and dinner & awards to be held on Saturday May 3, 2025 at Civic Centre, Victoria Island.

In 2024, Nigerian manufacturers recorded an accumulation of N1.4 trillion worth of unsold goods, attributed to inflation, diminishing consumer purchasing power, and a surge in electricity tariffs.

News and Report

New Report Puts Billionaire Tony Elumelu Net Worth At $2.15bn After Surging Growth By UBA, Transcorp

Published

4 hours agoon

March 11, 2025

Billionaire Tony Elumelu, (CFR) has a net worth of $2.15bn according to MoneyCentral’s analysis of stakes in various companies controlled by him, which have seen record growth in recent years.

MoneyCentral estimated Mr. Elumelu’s net worth as of March 10, 2025, by piecing together his stakes in companies, primarily through his family-owned investment vehicle, Heirs Holdings, and his direct and indirect holdings in publicly traded entities like Transnational Corporation of Nigeria (Transcorp) and United Bank for Africa (UBA).

Heirs Holdings investment portfolio spans the power, energy, financial services, hospitality, real estate, healthcare and technology sectors, operating in twenty-four countries worldwide.

It is inspired by Africapitalism, the belief by Tony O. Elumelu, that the private sector is the key enabler of economic and social wealth creation in Africa.

MoneyCentral defines a billionaire as an individual who has a net worth of $1 billion or more. In calculating net worth, we priced the stakes in public companies as of March 10, 2025 and included dividend income paid to that date.

Private companies were valued in several ways, most often by applying price-to-sales and price-earnings ratios of similar public companies. We tried to identify and confirm all potential liabilities; however, we made no assumptions about personal debt.

Moneycentral’s analysis is laid out below.

Publicly Traded Stakes

Transnational Corporation of Nigeria (Transcorp)

Ownership: Elumelu controls a significant stake in Transcorp via HH Capital Limited, Heirs Holdings Limited and personal/family holdings. As of Full Year 2024, his family’s stake (including wife Awele Elumelu) hit 35.93% or 3.652 billion shares per latest financials.

Elumelu’s 2,997,789,337 shares are held indirectly through HH Capital Limited and 68,386,431 shares are held indirectly through Heirs Holdings Limited. A further 68,276,011 are held directly.

A share reconstruction exercise was concluded in 2024, leading to a reduction in the volume of shares held, however the percentage holdings remain the same.

Market Value: Transcorp’s shares have surged from a reconstructed share price of N5.16 in March 2023 to N51 per share on March 10th 2025. Total market capitalization of Transcorp as at Monday March 10th was N523.8 billion.

The 35.93% stake was equivalent to N187.9 billion or $125 million (at N1500/$).

Growth: Transcorp Plc recorded 107% revenue growth to N407.9 billion ($271 million) in 2024, while Full Year profit rose a massive 189.7% to N94 billion ($62.6 million), signaling strength.

The Board of Directors approved and paid an interim dividend of N4,064,799,029.30 or 40 kobo per ordinary share (equivalent of 10 kobo per share pre capital reconstruction). The Board of Directors has proposed N6,097,198,543.95 or 60 kobo per share as final dividend, bringing the total dividend for 2024 to N10,161,997,574 or N1.00 per share.

It is instructive to note that Elumelu and family will be paid N3.65 billion as dividend for 2024.

United Bank for Africa (UBA)

Ownership: Mr. Elumelu is the Chairman of United Bank for Africa (UBA) and largest individual shareholder. Data from the 2023 financial statement (2024 numbers are awaited) shows that Elumelu owns a 7.43% stake in UBA.

UBA has 34.2 billion shares outstanding, with Elumelu’s shares comprising 2.3467 billion indirect shares owned through Heirs Holdings Limited (1.814 billion shares), HH Capital Limited (302.29 million shares) and Heirs Alliance Limited (231 million shares) plus 195.12 million direct shares.

Market Value: UBA’s share price hit N37.60 in March 10, 2025 trading, up from N23 per share a year ago in March in 2023.

UBA Chart

Source: Bloomberg

UBA’s market capitalisation is N1.286 trillion meaning Elumelu has a stake worth N95.54 billion or $63.69 million (at N1500/$).

Growth: UBA’s gross earnings rose significantly in the 9-months 2024 period by 83.2 per cent to N2.398 trillion up from N1.308 trillion recorded in September 2023.

There was a 20.2 per cent increase in Profit before Tax (PBT) to N603.48 billion from N502.09 billion recorded at the end of the third quarter of 2023, while profit after tax also surged by 16.9 per cent to N525.31 billion from N449.26 billion recorded a year earlier in the period under review.

Full Year 2024 numbers are being awaited but expected to follow the same trajectory as 9-montsh 2024 results.

Key Subsidiaries via Heirs Holdings

Heirs Holdings was founded in 2010 and is Mr Elumelu’s private investment engine and wholly family-owned (likely held via trusts or direct shares). It controls stakes across sectors and here’s the big ones:

Transcorp Power

Ownership: A Transcorp subsidiary, 50% owned by the group. Mr Elumelu’s 35.93% stake in Transcorp flows through here indirectly.

Value: Transcorp Power has a market captalisation of N2.73 trillion ($1.82 billion) as at March 10, 2025.

Elumelu’s share via Transcorp’s 36% is $653 million, however due to the classic conglomerate discount this is already baked into the Transcorp PLC’s valuation so there will be no double-counting by us.

MoneyCentral will include this in the Net worth of Mr. Elumelu in the future if personal or family owned stakes are revealed apart from ownership stakes through Transcorp PLC.

Growth: Transcorp Power is growing so fast that analysts are struggling to catch up. Transcorp Power reported a 115% increase in revenue to N305.9 billion for 2024, equivalent to 61 percent of its 2031 revenue targets being achieved last year with six more years still left (2025 – 2031) in the forecast period.

Profit after tax surged by 165% to N80 billion in Full Year (FY) 2024, from N30.2 billion in FY 2023.

Transcorp Hotels Plc

Ownership: This is another major subsidiary that is 76% owned by Transcorp Plc. It owns the flagship Transcorp Hilton Abuja.

Value: Same as Transcorp Power there will be no double counting through Transcorp Hotels when determining Mr. Elumelu’s net worth. However, Transcorp’s hospitality arm has a market capitalization of N1.292 trillion or $861 million.

Growth: Transcorp Hotels delivered 69% revenue growth to N70.134 billion in Full Year 2024, while profit after tax rose 138% to N14.895 billion.

As the major subsidiaries (Transcorp Power and Transcorp Hotels) continue to grow it will be reflected in the valuation of the parent Transcorp Plc and as such increase Mr. Elumelu’s net worth.

Heirs Energies (formerly Heirs Oil & Gas)

Ownership: Heirs Energies has demonstrated remarkable operational excellence since acquiring the OML 17 block in July 2021. Within just 100 days of taking over operations, the company doubled its oil production from 27,000 to 52,000 barrels per day.

The asset is 100% Heirs Holdings-owned which bought 45% of OML 17 for $1.1 billion in 2021 with Transcorp (Energy Capital Power). Heirs Energies is the sole operator of OML 17, in Nigeria’s Niger Delta.

Market Value: The asset (OML 17’s) output of 52,000 bpd with 2P reserves of 1.2 billion boe, and an additional 1 billion boe resources of further exploration potential and gas assets, suggest a $1.5-$2 billion valuation in 2025.

With Brent oil at $70/per barrel, Seplat a comparable indigenous oil producer with 52,947 barrels of oil equivalents per day (BOEPD) in 2024 had a market capitalization of $2.23 billion or N3.35 trillion as at March 10 2025.

We would value Mr. Elumelu’s full Heirs Energies stake through control of Heirs Holding, the owners of the asset at $2 billion, dropping to $1.75 billion due to potential profit split with Transcorp PLC.

Heirs Insurance Group (Heirs Insurance, Heirs Life Assurance)

Ownership: 100% Heirs Holdings.

Growth: Nigeria’s insurance market is small with about N1.5 trillion ($1 billion) in gross premiums in 2024. Heirs Group’s General and Life companies, combined, recorded a 59.30% increase in Gross Written Premium (GWP), rising from N19.9 billion in 2022 to N31.7 billion, for the year ending December 31, 2023, as they both enter their fourth year of operations.

In addition, the Group’s earned insurance revenue for year 2023 stood at N20.5 billion, a surge of 80% from N11.3 billion in 2022, reaffirming the Group as one of the fastest-growing insurance groups in Nigeria.

Value: The firm could garner a valuation of 2 times sales comparable to AXA Mansard Insurance.

This would value it at N42 billion or $28 million (2x revenue, per solid growth and industry norms). Mr. Elumelu’s full stake would then be also equivalent to $28 million.

United Capital Plc

Ownership: Heirs Holdings has a stake (the size is unclear, but we estimate at possibly 25%).

Growth: United Capital’s after tax profit surged by 111% to N24.1 billion from N11.4billion in 2023. In respect of the current year, the Directors propose that a final dividend of N0.50 kobo per ordinary share of 50 kobo each amounting to N9.0 Billion, be paid to shareholders upon approval at the Annual General Meeting.

Value: United Capital has a market capitalsation of N369 billion or $246 million as at March 10 2025. A 25% stake means Mr. Elumelu’s Net Worth would be valued at $61.5 million.

Other Assets used in calculating Mr. Elumelu’s Net Worth

Real Estate: Mr. Elumelu owns “extensive” Nigerian property (Forbes, 2024). There are no specifics, so we assign a $75 million conservative estimate for a billionaire’s portfolio.

Cash & Investments: Mr. Elumelu has got liquid assets especially with major dividends coming from all his investments. We estimate cash holdings at $50 million likely, per billionaire norms.

Philanthropy

Heirs Holdings is inspired by Africapitalism, the belief of the Chairman, Tony O. Elumelu, CFR that the private sector is the key enabler of economic and social wealth creation in Africa.

Driven by this philosophy, Heirs invest for the long-term, bringing strategic capital, sector expertise, a track record of business turnaround success and operational excellence to companies they invest in.

Mr. Elumelu’s philanthropic Foundation catalyses entrepreneurship across Africa, through the USD $100million Tony Elumelu Foundation Entrepreneurship Programme, advocacy and research.

Bottomline: Tony Elumelu’s Total Net Worth Estimate is $2.15 billion

Source of wealth

Source: MoneyCentral

News and Report

CBN’s 16 new directors and the parochial jeremiad – Toni Kan

Published

6 hours agoon

March 11, 2025

Competence should be agnostic.

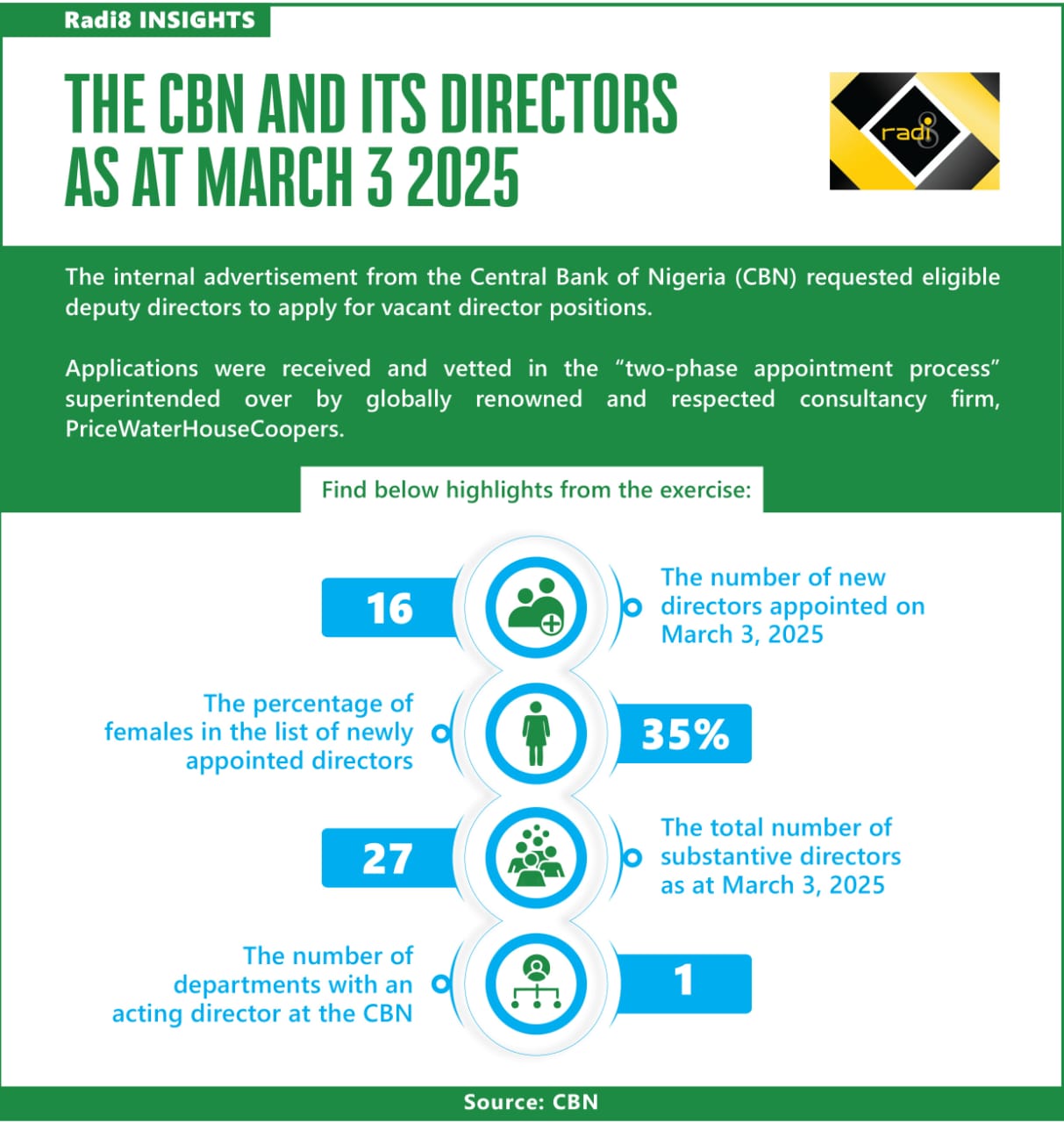

This was the thought that occurred to me as I read a piece referencing the recent appointment of 16 directors by the Central Bank of Nigeria (CBN) in what has been described as a rigorous, thorough and well-organised “two-phase appointment process.”

And in considering the furore that has erupted in the wake of the conclusion of the recruitment exercise with commentators from a section of the country alleging ethnic bias, I recalled a story I was told at a party years ago in Atlanta.

An old southern lady was rushed to the ER by ambulance. She presented with abdominal pain. Tests showed that she had a ruptured appendix and she was rushed to the theatre for an emergency appendectomy.

But when a black surgeon came in to operate on her she screamed. “I ain’t letting that N!gg@r touch me!”

It was her daughter who had come with her in the ambulance who gave her a hot slap which, as we say in Nigeria, reset her brain.

When I heard that story I remember saying to my American host, “Dana, in Africa we don’t slap our parents”

Dana’s answer was a simple, “Toni Kan, you are missing the point.”

The Nigerian economy is like that old southern lady; it is in dire straits and while the financial and fiscal authorities are working hard to get it on an even keel people are focusing on the tribes of the surgeons assembled to perform life-saving surgery.

A month ago the attack was against three women. Luckily, in that instant, all three women hailed from various parts of the country so tribal bias was not invoked as it is being done now.

In this case, with ethnic bias being alleged in the emergence of the 16 newly appointed directors, one is constrained to ask; when will it end, these irksome microscopic examinations of the Central Bank of Nigeria’s hiring practices.

It should be simple to understand that when it comes to picking the best to do a critical and intensive job we must look past tribe, religion and creed. Yes, there is the principle of federal character – which we are quick to invoke when things don’t go our way – but some national assignments demand the consideration of a different approach; one whose focus on competence, qualification, experience and merit should trump any other consideration.

How did we get here?

The CBN advertised, internally, for eligible deputy directors to apply for vacant director positions. Applications were received and vetted. The first round of interviews was conducted by human Resources and Director Generals before the next round which now had the CBN governor, Yemi Cardoso involved. The process was overseen from beginning to end by world renowned consultancy firm, PriceWaterHouseCoopers in order to ensure not just transparency but alignment with global best practice.

At the end of the exercise 16 new directors were appointed on March 3, 2025 and they include: Dr. Rakiya Opemi Yusuf (Payment System Supervision Department), Dr. Adenike Olubunmi Ojumu (Medical Services Department), Dr. Aisha Isa-Olatinwo (Consumer Protection Department), Mrs. Rita Ijeoma Sike (Financial Policy and Regulation Department), Mrs. Monsurat Vincent (Strategy Management and Innovation Department), and Mrs. Omoyemen Avbasowamen Jide-Samuel from the Information Technology Department), Mr. Hamisu Abdullahi (Banking Services Department), Dr. Usman Moses Okpanachi (Statistics); Dr. Oboh Victor Ugbem (Monetary Policy); and Mr. Farouk Mujtaba Muhammad, (Reserve Management.), Mr. Olubukola Akinniyi Akinwumi (Banking Supervision), Hassan Ibrahim Umar (Development and Finance Institutions)

The rest are Dr. Adetona Sikiru Adedeji, ( Currency Operation and Branch), Mr. Mohammed-Jamiu Olayemi Solaja, (Other Financial Institutions Supervision), Mr. Musa Nakorji (Trade and Exchange Department) and Mr. Kayode Olarewaju Makinde ( Procurement and Support Services).

The appointment of the 16 new directors with a 35% female representation brings to 27 the total number of substantive directors at the apex bank. At the conclusion of the exercise only the Corporate Communications department had an acting director.

The delay many not be unconnected with the merging of the newly created Investor Relations Department with the Corporate Communications Department in what a source described as “part of the Bank’s strategic efforts to enhance stakeholder engagement, optimize resources, and ensure a more coordinated approach to communication.”

The new directors have been described as “best-in-class” and “distinguished individuals who have demonstrated exceptional expertise, leadership, and commitment” to lead the Bank into the future.

While the process that led to the emergence of these new directors went smoothly, the reception has been anything but. Scathing commentaries in the papers and blogosphere have alleged an ethnic slant in the appointments while also purporting that deputy directors from a particular part of Nigeria were shortchanged.

Phrases like “regional favoritism”, glaring marginalistion”, “regional sentiments” have been bandied around to justify the supposed “unprecedented imbalance” and what one of the commentators described as “serious concerns about fairness, inclusivity and the credibility of the apex bank.”

But the fact to take away from all this especially as the CBN’s policies are beginning to impact the economy positively is a simple one; when it comes to dealing with the financial health of our nation, we must rise above atavistic parochialism.

A man laid out on the operating table does not worry about the race or religion or tribe of his surgeon. His major concern is whether the surgeon is capable, competent and experienced.

We must teach ourselves to take the same approach when it comes to working on the financial health of the nation by looking for the best hands within the system to lead the CBN into a new era.

That is what I think the bank has done and as staffers attest the exercise produced the right, experienced and qualified candidates but as Dana, my American friend told me many years ago, tribal irredentists “are missing the point” as usual.

***Toni Kan is a PR expert, financial analyst and biographer.

Experts to tackle declining consumer purchase power at 2025 Industry Summit

New Report Puts Billionaire Tony Elumelu Net Worth At $2.15bn After Surging Growth By UBA, Transcorp

Breaking: Court Rules in Favor of Tunde Ayeni, Against Adaobi Alagwu

EXPOSED: HOW SACKED NNPC BOSS BILLY AGHA SPENT OVER N100 MILLION ON HIS GIRLFRIEND’S ARABIAN BIRTHDAY PARTY

Just In: Covid-19: Socialite Bolu Akin-Olugbade passed on at Paelon Covid Centre, Ikeja.

Stanbic IBTC In Trouble As Supreme Court Orders Bank To Pay Customer ₦2.5Billion

Trending

-

Society7 years ago

Society7 years agoEXPOSED: HOW SACKED NNPC BOSS BILLY AGHA SPENT OVER N100 MILLION ON HIS GIRLFRIEND’S ARABIAN BIRTHDAY PARTY

-

Society4 years ago

Society4 years agoJust In: Covid-19: Socialite Bolu Akin-Olugbade passed on at Paelon Covid Centre, Ikeja.

-

News and Report6 years ago

News and Report6 years agoStanbic IBTC In Trouble As Supreme Court Orders Bank To Pay Customer ₦2.5Billion

-

News and Report7 years ago

News and Report7 years agoDelta 2019: Gov. Okowa’s ambition cripples Asaba Airport upgrade…. • As ULO Construction Company pulls out • Okowa allegedly diverts N1.5Bn budgeted for the project

-

News and Report8 years ago

More Queen’s College pupils take ill…• Parents call for prosecution of ex-principal

-

Society4 years ago

Society4 years agoIMO PCC COMMISSIONER, WILLY AMADI IN VIRAL THREESOME SEX VIDEO SCANDAL

-

News and Report6 years ago

News and Report6 years agoGTBank Releases 2018 Full Year Audited Results …….. Reports Profit before Tax of ₦215.6 Billion

-

News and Report7 years ago

GTBank Releases H1 2018 Audited Results, Reports Profit Before Tax Of ₦109.6 Billion