...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

Cool Financial Services, a Lagos State-based finance house, has sued First City Monument Bank (FCMB) for allowing Goewe and Sons Ltd., one of its borrowers, to withdraw a N150 million loan sum from an account with an active freezing instruction.

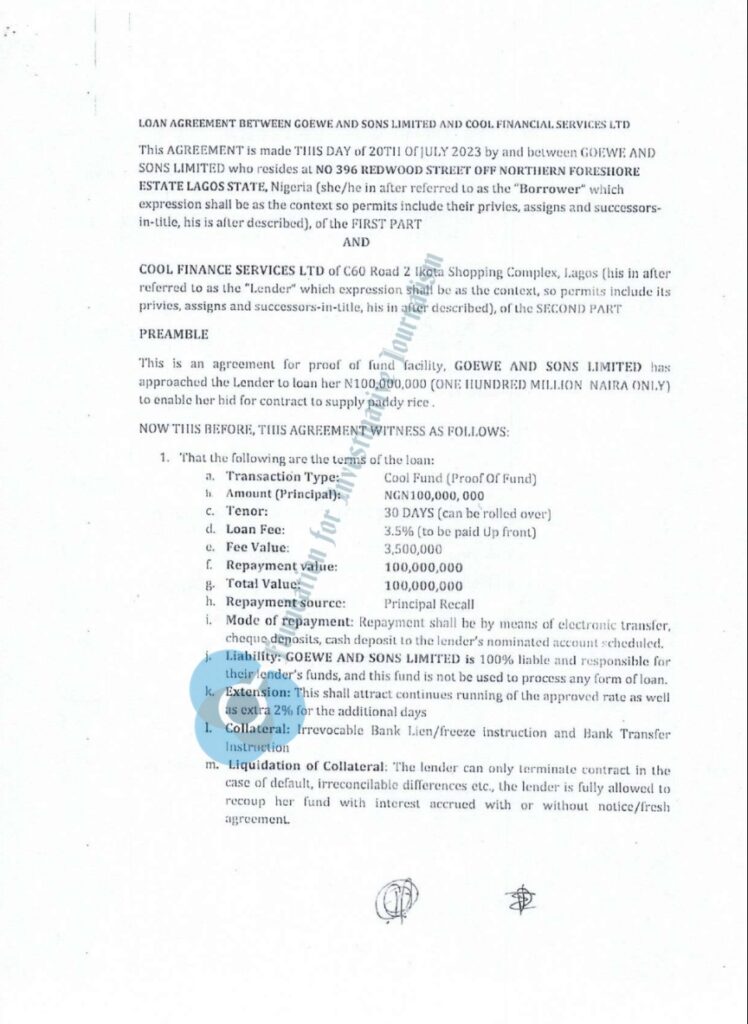

Goewe and Sons Ltd. is a merchandise company owned by Ewere Godwin Orobosa. In July 2023, the company first approached the finance house for a N100 million loan at a 3.5% interest rate for a duration of 30 days.

Again, in September 2023, the company obtained an additional loan of N50 million at an interest rate of 1.5% for a month, bringing the entire loan to N150 million.

The borrower intended to pursue a contract and needed to have the said amount in its bank account, but the loan was not to be used to execute the potential contract.

Both Goewe and Sons Ltd. and Cool Financial Services then instructed FCMB to freeze the loan account so that the loan sum could remain untouched for the period of the transaction, according to a loan agreement dated September 18, 2023.

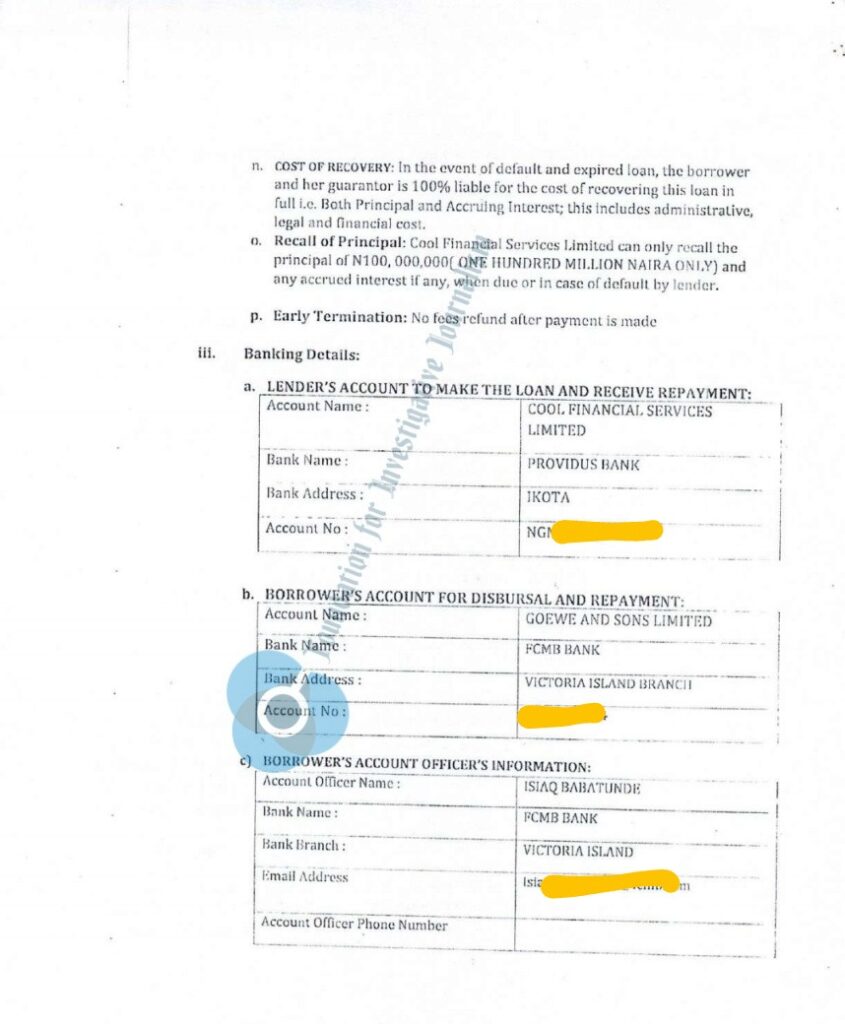

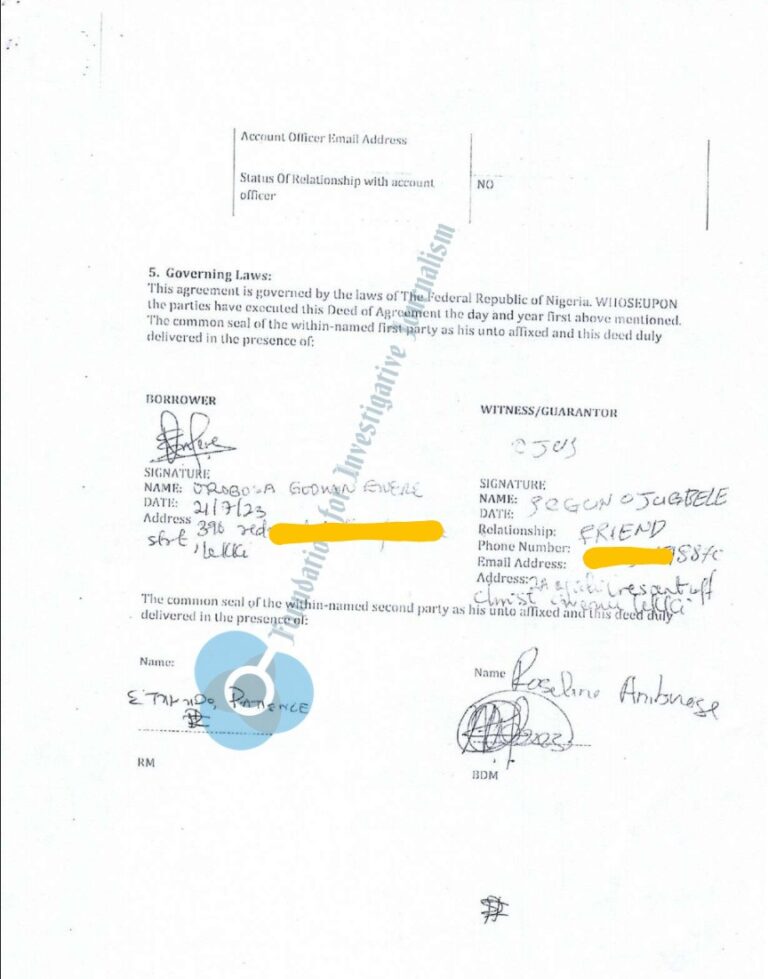

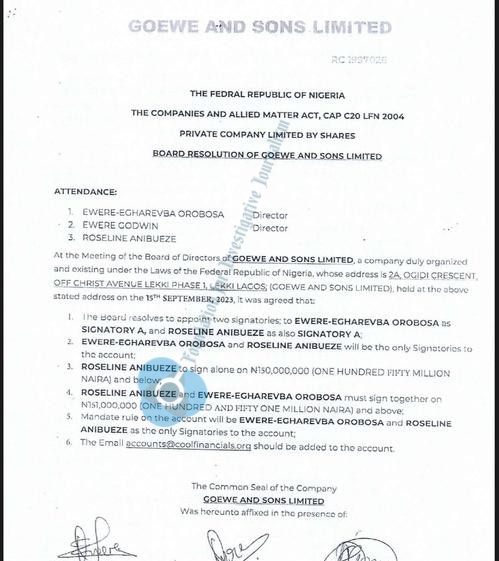

The borrower had earlier written to the bank to alter its account mandate through a board resolution dated September 15, 2023. The borrower appointed Ewere-Egharevba Orobosa, representing the borrower, and Roseline Anibueze, representing the lender, as ‘Category A’ signatories to the account.

The directive further specifically stated that the representative of the lender shall have the power to authorise any withdrawal below N150 million from the account while any withdrawal exceeding that amount shall be jointly authorised by the two signatories.

“Those measures were put in place to guarantee compliance with the terms and conditions of the loan facility,” Oluwafemi Adediran, head of the legal unit at the finance house, told FIJ on Wednesday.

After the loan duration expired, the lender wanted to withdraw it. So, on October 23, 2023, the finance house presented a transfer cheque at the Chevron branch of FCMB in Lagos confident that the money was intact. But the cheque was dishonoured and the bank revealed that the borrower had already withdrawn the loan.

“Upon our investigations and findings, we became aware albeit shocked that you disregarded the lien on the account and processed a loan of N150,000,000 (one hundred and fifty million naira) on the back of the restricted facility meant only as proof of funds. What is more, we are alarmed not only by this act but by the temerity and obviously premeditated criminal falsification of the signatures of the representatives of our client as signatory ‘A’ before the consummation of the unauthorised mindless transaction,” Justice John, a legal practitioner, wrote to a business manager at Sanusi Fafunwa Branch of FCMB and the FCMB managing director on behalf of the lender on September 26, 2023 and October 26 respectively.

On October 25, 2023, the lender visited the Sanusi Fafunwa Branch. There, Chukwuma Chukwuka and Isiaq Babatunde, both officials of the bank, appealed for a cure period of 72 hours to remedy the situation. An additional 48 hours was given to the bank to sort out the issue internally, according to a November 2023 court filing signed by Anibueze.

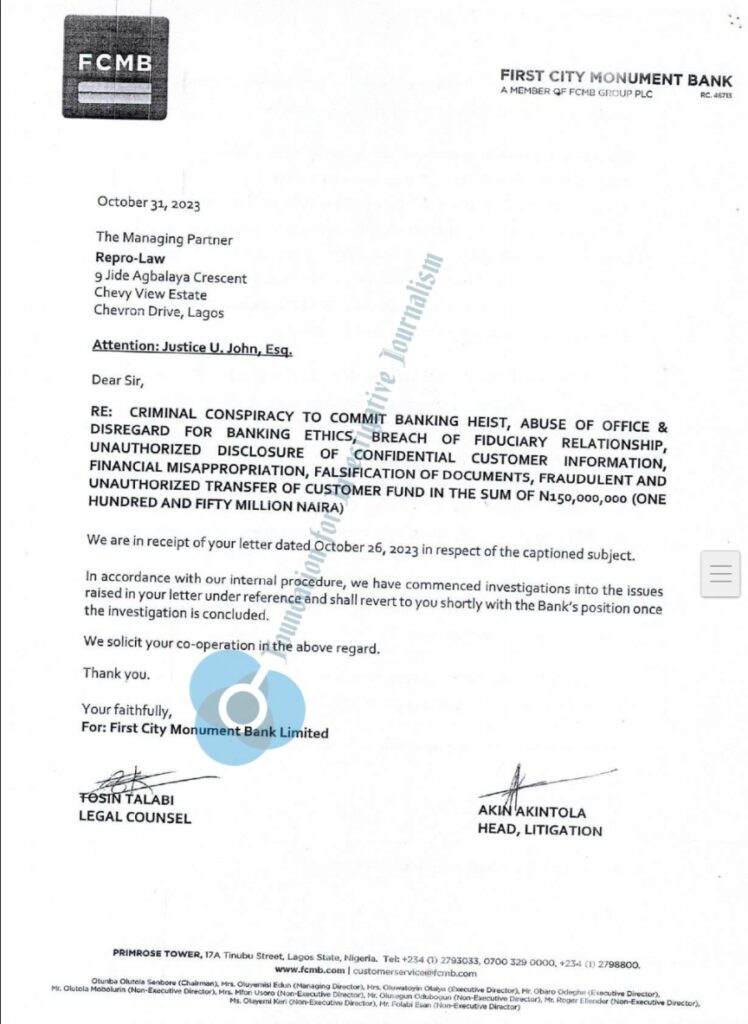

Those cure periods were not adhered to. On October 31, FCMB through Tosin Talabi and Akin Akintola, both legal counsel and head of litigation for the bank, said it had commenced an investigation into the issue.

“In accordance with our internal procedure, we have commenced investigations into the issues raised in your letter under reference and shall revert to you shortly with the bank’s position once the investigation (sic) is concluded,” the legal counsel wrote.

“At the time we went to the bank to verify how the money was withdrawn, we found out that the freezing instruction was still active on the account. We observed that our director’s signature was forged to make the withdrawal. The question the bank has not answered is, ‘How was it possible to withdraw money from an account with an active no-withdraw order?’”

More than a year after the letter referenced above, the bank was yet to reveal the findings of its investigation.

SEEKING REDRESS THROUGH COURT

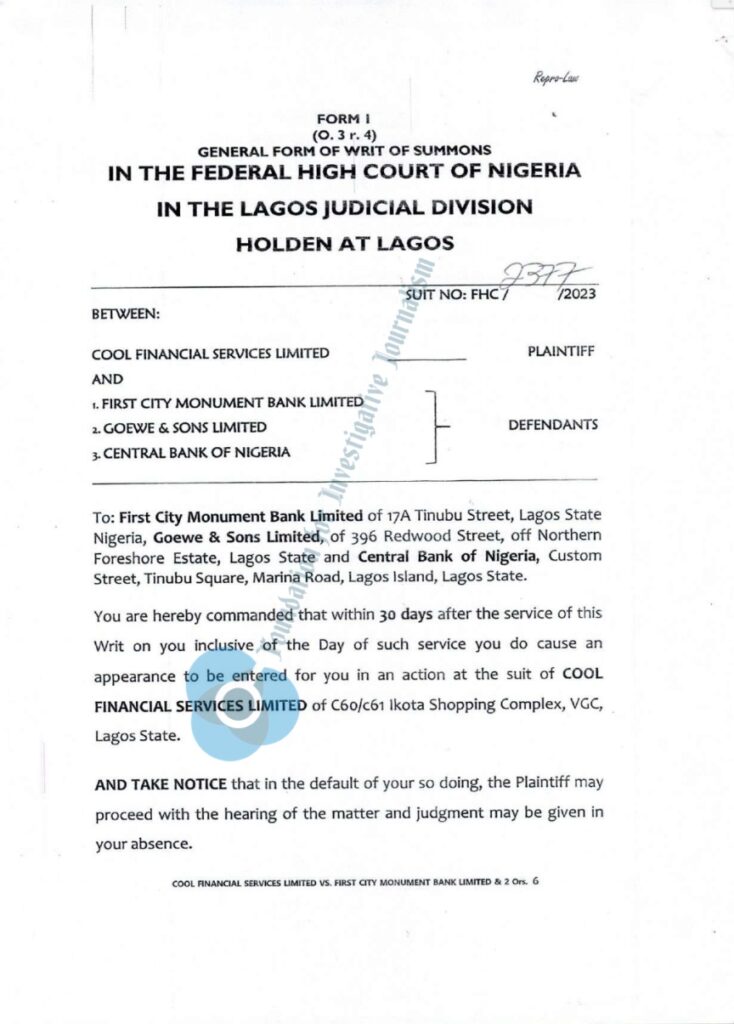

In November 2023, the lender filed a suit marked FHC/2377/2023 before a Federal High Court in Lagos seeking to recover losses it had incurred as a result of what it considered “a criminal conspiracy”.

Sued in the lawsuit were FCMB as the first defendant, the borrower as the second defendant and the Central Bank of Nigeria (CBN), FCMB’s regulator, as the third defendant.

“A declaration that the action of the 1st defendant amounts to breach of fiduciary duties owed to the plaintiff,” the first leg of the relief read.

“An order directing the 1st defendant to immediately pay the plaintiff its capital in the sum of N150,000,000 (One Hundred and Fifty Million Naira Only) with (an) interest rate of 21% per annum or at the prevailing Central Bank of Nigeria’s rate from October 23, 2023, when the plaintiff’s transfer request was dishonoured by the 1st defendant despite the plaintiff’s account being funded; and without any satisfactory explanation by the 1st defendant to the plaintiff.

“General damages in the sum of N250,000,000 (Two Hundred and Fifty Million Naira Only) against the 1st defendant for the economic loss, embarrassment and financial exposures suffered by the plaintiff as a result of the devastating action of the 1st defendant, bearing in mind that the plaintiff is in the business of loans and SMS financing.

“An order of this honourable court directing the 1st defendant to pay interest on the judgment sums at the rate of 21% per annum or at the prevailing Central Bank of Nigeria’s rate, from the commencement of this suit till the date of judgment, and 14% per annum from the delivery of judgment till liquidation of the entire judgment sum to the plaintiff.

“An order of this honourable court directing the 3rd defendant to enforce compliance of the 1st defendant by drawing from the deposits of the 1st defendant in its care to settle all monetary sums and liabilities thereof by the 1st defendant herein in the event that the 1st defendant is unable to pay same.

“The cost of this action in the sum of N5,000,000 (Five Million Naira).”

The court has not fixed a hearing date for the case. At press time, FIJ learnt that FCMB had not filed any response to the lender’s filings.

FCMB had not responded to a request for comments at press time. On January 15, Rafiu Muhammed, a corporate affairs and media management officer at the bank, acknowledged FIJ’s email on the phone and promised that the bank would investigate and respond soon.

When asked to be specific when the bank would respond, Muhammed said, “I don’t want to give you an unrealistic time. But we will investigate and respond very soon.”

FIJ sent him a reminder on January 24 and Muhammed responded, “Give us till next week.”

FIJ called him again on Wednesday and Muhammed requested one more week. “We will try to expedite our investigation. Give us till next week,” he repeated.

THE BORROWER’S RESPONSE

In the court documents, the lender accused the borrower of falsifying Anibueze’s signature and conspiring with the bank to withdraw the money.

On January 15, FIJ contacted Godwin Ewere, the director of the borrower, for his comments. He denied falsifying any signature, stating that he had defrayed the loan and was no longer indebted to the lender.

“The loan obtained from Cool Financial Services has been fully paid and liquidated. We no longer owe Cool Financial Services. No signature was forged whatsoever,” Ewere said, adding that he also wanted to sue FCMB.

“I don’t want to say anything, because I want to sue FCMB.

“I am ready to meet them in court. I still see my name on (the) credit bureau that I am owing them [the lender]. They are saying over N20 million, which I don’t understand.”

Ewere showed FIJ a harmonised document containing a series of cheques he issued in the name of the lender.

When FIJ relayed Ewere’s response to the lender’s head of legal unit, he said it was a lie. He maintained that the borrower defaulted in repaying the loan and also withdrew the money illegally.

Source: FIJ

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)