...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

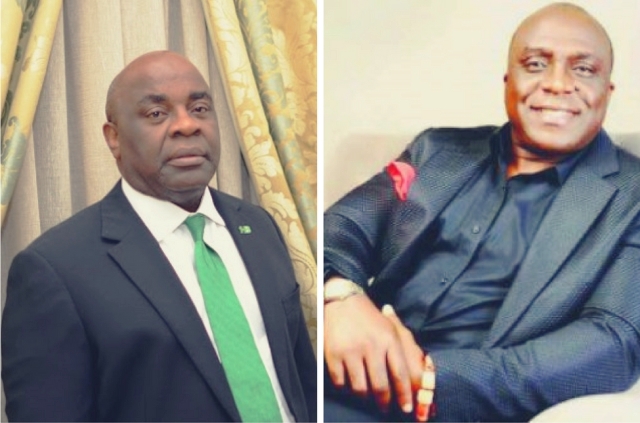

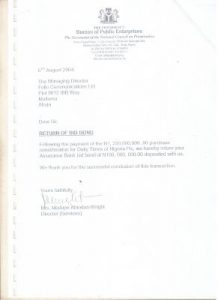

The fight against corruption by the Buhari administration may have had difficulties finding it footing in its two years in office even as it grapples to mount a concrete battle against the criminal cabal subverting the economic and financial systems of the nation. This is as information available to us indicate the recent financial activities of the duo of Adewumi Ogunsanya [Chairman DSTV] and Ikechukwu Obiorah [former Senator representing Anambra South District] require the attention of the anti-graft agency, EFCC, [Economic and Financial Crimes Commission] for investigation and onward persecution. Our correspondent uncovered what appears a criminal gang spearheaded by the former Senator and the Chairman of DSTV. Their mode of operation entail acquiring fraudulent court judgments against choice properties. One of such brazen illegal acquisitions is a property located in the highbrow area of Ikoyi [No. 15 Copper Road, Ikoyi] in Lagos State. The property which belongs to Daily Times of Nigeria under the ownership of Folio Communications Limited and valued in excess of N1.5billion was duly acquired by Folio Communications Limited through BPE [Bureau of Public Enterprise] on August 5, 2004.

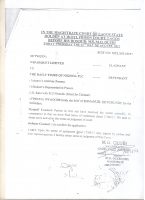

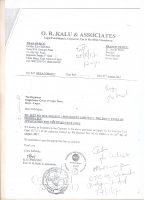

Senator Ikechukwu Obiorah who have been impersonating the owner of DTN [Daily Times of Nigeria] – and had previously made numerous failed attempts at taking over the ownership of DTN, have been instructed by the Courts to desist parading himself as the owner of DTN. Having failed at overtaking the owners of DTN, Senator Obiorah hatched another plot to commandeer the properties belonging to DTN, and to sell them off. The former Senator found a willing partner in the person of Adewumi Ogunsanya, the chairman of DSTV. To achieve his plot, Senator Obiorah instituted a suit against himself – a fictitious suit. Posing as the owner of Daily Times of Nigeria, he sued the Daily Times of Nigeria using one of his unknown companies by the name WIPARQUET Limited. Emmanuel Ekwurundu served as counsel for Daily Times of Nigeria while Rowland Kalu served as counsel for WIPARQUET. The suit was brought at the Magistrate Court of Lagos at Ikoyi on August 2017. Mr. M. O. Olubi served as Magistrate. The claimant [WIPARQUET], according to the fictitious suit, sued Daily Times of Nigeria for a debt of N2.5million. And in a manner depicting the criminality in Senator Ikechukwu Obiorah’s plot, he stood in for Daily Times of Nigeria and willingly told the court he was willing to forfeit the Daily Times of Nigeria property at No. 15 Copper Road, Ikoyi to WIPARQUET Limited. The supposed two parties agreed on out of court settlement – where the N1.5billion property was handed over to WIPARQUET to cover the debt of N2.5million.

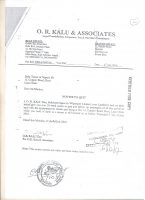

Receipts and Payment Checks For Purchase of Daily Times & Fraudulent Out Of Court Document

In essence, Ikechukwu Obiorah got the Magistrate court to hand the property to him. Shortly following the court settlement, Senator Ikechukwu Obiorah brought in the big money man, the Chairman of DSTV, Adewumi Ogunsanya – who then remitted the sum of N750million into the Bank account of Senator Ikechukwu Obiorah at Heritage Bank. The money is payment for the said property. Adding muster to already odorized situation, Senator Obiorah upped the garnet. Using purchased warrants gotten from a corrupt officers, he moved to arrest and detain the owners of Daily Times of Nigeria – to intimidation and silencing. On January 19, 2018, Senator Obiora invaded Daily Times Head office in Lagos with 6 riot policemen abducting 5 DTN officials and carting away computers. Specifically, Obiora arrived the premises of Daily Times Nigeria armed with six riot policemen wearing the SARS tag with bulletproof vests along with armed hoodlums at the Agidingbi Ikeja Office at about 9am on January 19. The abducted workers included, the admin officer, an accountant and two graphic designers. They were taken to an unknown location. This was followed by a hair raising arrest of the management staff of Folio Communication Limited – Fidelis Anosike and Noel Anosike. The two were taken to a police station in the remote area in the federal capital territory – where they were detained and made to spend the night at the police precinct. As morning came, the duo were taking to a Magistrate court in Mpape – where a Magistrate, Azubuike Ukagu renowned for his nefarious activities quickly remanded the duo to Kuje prison – for a case already tagged a civil case by the Inspector General of Police. The supposed prosecutor, ACP Njoku was driven to the Magistrate court by Senator Ikechukwu Obiorah.

Senator Obiorah along with Adewumi Ogunsanya have since demolished the Ikoyi structure. Adewumi Ogunsanya is expected to complete the payment of the remaining N850million to Senator Obiorah. Already, the office of the Inspector General of Police is reported to have launch an inquiry into the illegal arrest of the staff of Folio Communication – with the intention to fish out the police officer who may have connived with Senator Obiorah.

Stay tuned…

Source: 247ureports

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)