...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

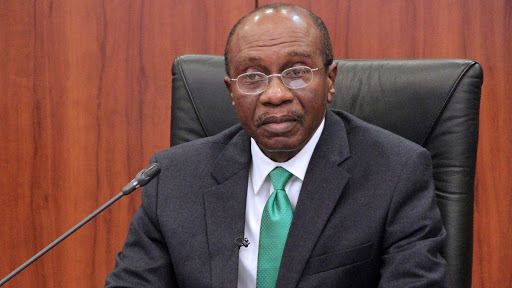

The Secretary of the dissolved Presidential Committee on Reconciliation and Recovery of Stamp Duties Revenue, Kazaure Gudaji has narrated how N89 trillion from stamp duties was misappropriated and diverted by the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele.

Garba Shehu, presidential spokesperson, on Saturday, debunked Kazaure’s N89 trillion missing funds claim, adding that it was “ludicrous that a member of the parliament would claim to be secretary of an executive committee”.

Kazaure had said his committee was secretly constituted by President Muhammadu Buhari, with Adetola Adekoya and him as the chairman and secretary respectively.

He explained that he, in a letter dated 8 August, sought the approval of Mr Buhari to set up the committee that included the Minister of Finance, Zainab Ahmed, the Attorney-General of the Federation, Abubakar Malami, the Director General of the Department of State Services (DSS), Yusuf Bichi, Mohammed Wakili, a retired commissioner of police and one Mr Okafor, a retired staffer of the National Intelligence Agency.

A source in government told SaharaReporters on Wednesday that President Muhammadu Buhari is not aware of a lot of things going on in his government, including details about the Stamp Duty charges. The source added that knowing this weakness, the people around Buhari have ensured he doesn’t get to know about some fraudulent activities going on in his government.

“The President is not aware of all this because all the people surrounding him are not allowing anything that will expose them to pass to him, but now he understands they are cheating him,” the source said.

In a fresh document obtained by SaharaReporters, the lawmaker narrated how the funds were diverted using multiple circulars.

Kazaure added that the committee had flagged the funds ($171.0 billion) in CBN’s private investors account.

It also flagged funds recycled as loans to some banks, N13 trillion; and funds “recycled as FMDQ debt to FGN: N23.3 Trillion”.

He said, “How CBN Circular of 27th March 2013 was used to divert the revenue. School of Banking Honours “SBH” is a banking monotechnic that was registered by JAMB as an Innovation Enterprise Institution “IEI” under a new Federal Education policy to skill, re-skill and up-skill Nigerian Youth on all aspects of banking operations techniques, in making them to be more employable locally, and competitive globally. As SBH does not receive subvention or grants from FGN, it applied loans on research to make a difference on tertiary banking skills.

“With retrenchments ravaging the banking sector, SBH adopted a strategy to create part-time banking jobs for Nigerian youth from GAPS in banking services, hence it began to research into embossed Stamp Duty Paid symbol on cheques.

“When CBN refused to partner on SBH research for “shadow-banking” to absorb our youth on part-time jobs in February 2012, SBH invited NIPOST to represent FGN thereon, and a Master Services Agreement was signed in September 2012. SBH returned to CBN for Approvals to engage banks and others for N50 Stamp Duties on manual teller deposits and electronic transfer receipts from N1000 and above, and to sweep these into FGN coffers.

“CBN obliged SBH by issuing its Approval letters, with that of 3rd December 2012 stating that this was against its policy on financial inclusion, but that despite this, all revenue arising thereon must be swept into FGN coffers on monthly basis. For manual collections on Cheques, SBH invited 3 lead banks (First Bank, Stanbic IBTC and Unity Bank), and they committed to their roles. SBH then called a press conference with NIBSS for all bank customers on their obligation.

“SBH engaged NIBSS as Official Sweeping Agent to FGN on the new revenue, but its then CEO, Mr. Folashodun Adebisi Shonubi (now CBN Deputy Governor) complained, via email dated 18th January 2013 that the CBN Approval was not meant to increase cost of banking to customers; and Payment of N50 Stamp Duty on a N1000 transfer is “absurd” hence the threshold must be increased upwards. Quite unbelievably, NIBSS induced CBN to issue a Circular on 27th March 2013 for an aggregate N100 (i.e. banks N70; NIBSS N30) as “additional charges” on transfers from below their own N500,000 threshold, down to N1000 of Stamp Duties, while N50 Stamp Duties of Government in 2012, was blocked. What then started as “breach” of financial inclusion for banks / NIBSS against FGN in 2013, has now snowballed into monumental fraud that is unknown in banking history.

“Undaunted, the SBH continued its due diligence, and served a Demand Notice for N7.7 Trillion on NIBSS, being Stamp Duties assessed for 2013/2014. NIBSS accepted, and invited SBH on 5th July 2015, for “full recovery” of all share of Government collections. The latter then invited Revenue Mobilization Allocation & Fiscal Commission “RMAFC” to replace NIPOST that had gone on a judicial misadventure with Mr. Buruji Kashamu “KASMAL” which heralded its eventual nullification from any Stamp Duties collection by an Appeal Court.

“RMAFC had no satisfactory answer from CBN + NIBSS, while its Chairman. alerted in-coming President Muhammadu Buhari against Mr. Emefiele’s buy-out plan of Nigeria’s OIL Joint Venture shares at N14.9 Trillion in funding his critical infrastructure needs. SBH then related N7.7 Trillion demanded on NIBSS, to the N14.9 Trillion buy-out offer from Mr. Emefiele, are 1:2 ratio, and also similar to N50 Stamp Duties and N100 bank charges. So, Mr. Emefiele had shown interest in laundering Stamp Duties to acquire FGN asset since 2015..!

“School of Banking Honours processed its Copyright No. LW1023 on the intellectual research works, and is now representing FGN on all technical aspects of the Stamp Duties since 27th September 2012, and as duly registered on 15th October 2015 under Laws of the Federation.”

The lawmaker continued, “How CBN Circular of 15 January 2016 tried to distort 1st diversion: CBN issued a Circular on 15th January 2016 “in exchange” for an illegal waiver granted to it by Kasmal and NIPOST on all Stamp Duties due from NIBSS recovery invitation for 2013/2014 years, while 2 judgments presented by Kasmal to CBN on same matter revealed disparity on a purported contract (i.e. NIPOST and Kasmal) with terminal dates of October 2018, and October 2015, while 5% commission was inflated to 15%, even as NIPOST wrote CBN to deny formal contract thereon.

“Director of Public Prosecutions (DPP) of Justice Ministry directed EFCC in March 2016 to investigate the purported Agreement, and SBH was invited to submit memos, but the outcomes have been suppressed between Justice / EFCC till date.

“How CBN Circular of 21st February 2017 diverted revenue from FGN:

1. Total foreign exchange of US $171 Billion that accumulated into CBN Private Investors Account within 3 years to April 2020, was derived from above: a. Mr. Emefiele directed all banks to share their processing fees with CBN in ratio of 40:60, but the fees were not credited to income statement of CBN, but to Private Investors Account on foreign exchange trade.

“b. All forex traded by CBN with bureau-de-change operators are “privately” owned, hence the indifference of Mr. Emefiele to continued devaluation of Naira from about N250 to the Dollar in 2015, to about N700 now.

2. Total loans of over N23.4 Trillion from CBN to some banks as at December 2019, were mostly from the Stamp Duties revenue that was diverted, given that:

“a. NIBSS alerted SBH that N50 Stamp Duties on bank transfers from N1000 and above, would deliver revenue that is far above OIL; and

b. CBN share capital was just N5 Billion, while its reserves were only N280 Billion (all totalling N285 Billion), as at December 2019.

“3. Total Debt Stock variously issued to Federal Government “FGN” via Financial Markets Dealers Quotes “FMDQ”, was stated at about N13.0 Trillion, and this was far in excess of its balance sheet size. For instance, the following ratios as at December 2020 show areas for due diligence:

“a. N13.0 Trillion Debt issued by FMDQ to Government is 94.5% of total Bonds, while non-Government are about 5.5%. This confirms FGN as the easiest source for laundering CBN slush funds as Debt stock.

b. However, FMDQ’s own fund on the portfolio is just about 0.4%, hence the need to review the sources of CBN funds recycled into FGN Debt. Desperation of CBN to cover-up Stamp Duties revenue:

“In line with Section 3(2) of Stamp Duties Act, Finance Minister has not reported the Copyright-holder’s Invoice of N89.1 Trillion to 36 State Governors for over 1 year, while CBN Governor refused to transfer the unremitted Stamp Duties from its Private Investors Account, into STAMP DUTIES CENTRAL ACCOUNT for the monitoring convenience of Mr. President, as ordered.

“Private Investors Account on foreign exchange was opened by CBN in April 2017, and then funded from CBN Circular of same April 2017. Even EFCC that SBH approached for support on 31st May 2021 has not disclosed its investigation outcome on the accounts publicly, or forwarded a report on the balances to Mr. President for over 1 year.

“Furthermore, Stamp Duties revenue accruing to FGN is still growing at an astronomical rate, and this is quite evident from latest NIBSS statistics that reported eTransactions at N117.3 Trillion in just 4 months of 2022 alone, and by conservative estimates, these could reach over N400 Trillion by year end. It must be noted that NIBSS is just 1 of 15 other switches whose records have not been captured by Copyright-holder, and CBN is jealously guarding the huge revenue that is “above OIL” from Government…!”

The committee according to the document also recommended the suspension of the CBN Governor.

- Sahara Reporters

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)