...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

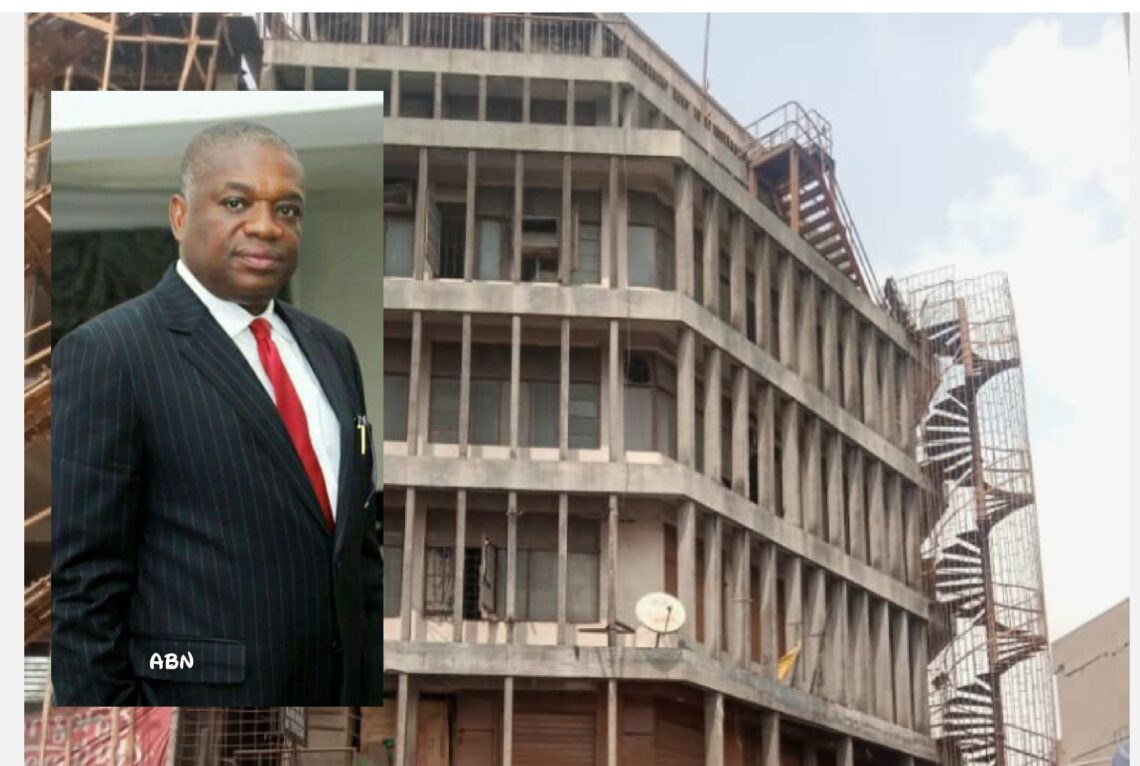

The six-storey building at 45, Martins Street, Lagos, flaunts a rich history. The Federal Radio Corporation of Nigeria (FRCN) acquired the property after the country’s Independence in 1960 and structured it into a broadcasting station.

The first Frequency Modulated (FM) station in the country, Radio Nigeria 2 (RN2) began broadcasting from there, infusing entertainment into radio broadcast, a role it admiringly played for many years, spewing sonorous music, and producing exciting plays and short stories.

That exemplary narration has, however, changed. The building housing Radio Nigeria 2 (RN2), as the station was widely known, is today a burnt edifice enmeshed in sale and management controversy. Invariably, the property was sold without the owner (FRCN) knowing about it. What is even more curious is that it was sold over 10 years ago with no one coming forward to claim ownership – until recently.

But that is not the only curious thing about the sale of the property. Investigations by The ICIR shows that the building was sold (in actual fact, leased for 99 years) in 2010 by the Presidential Implementation on the Sale of Government Property to Seamen Traders Nigeria Limited without the knowledge of FRCN.

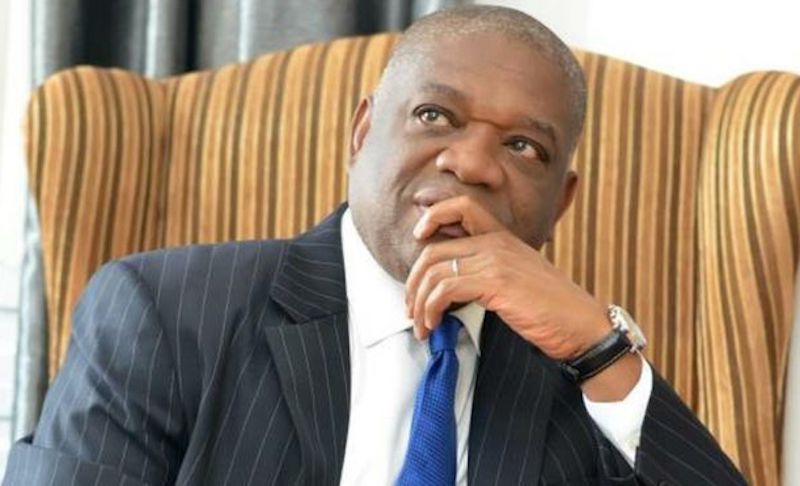

Further investigations revealed that Seamen Traders was issued a Certificate of Occupancy by the Federal government on May 17, 2010. A search at the Corporate Affairs Commission (CAC) showed that Seamen Traders is owned by Orji Uzor Kalu, businessman, newspaper publisher and senator representing Abia North. The company, which was incorporated in February 1988, has Christiana Orji and Obinna Moore as the other directors.

Also curious is the fact that the property was sold for N100 million, whereas independent evaluation puts its worth at least one billion naira. What is more, there is no evidence that the pittance for which it was sold was ever paid into government coffers.

Property’s chequered history

On November 6, 2019, fire razed the imposing building, which Adebowale Stores Limited (ASL) had managed as lessee for some 19 years on behalf of the FRCN. That would be the second major fire damage to the building.

ASL had been a tenant in the building for about 20 years when fire first gutted the building on November 15, 1997, wreaking extensive damage. As the property remained unrepaired two years after the fire incident, the founder and chairman of ASL, Hamza Beyioku Adebowale, wrote to the FRCN in December 1999, indicating his company’s desire to repair the uninsured building and acquire a leasehold on it. The FRCN management agreed and, on May 29, 2000, both parties signed a five-year lease agreement.

FRCN kept us in the dark on sale – Adebowale

ASL had since then been the manager of the property until the 2019 fire tragedy and, as the company’s Head, Corporate Services/Company Secretary, Yishau Habeeb, put it, was hoping its long tenancy and lease relationship with the FRCN would put it in a position of advantage if and when the federal government eventually decided to sell it. That hope would turn out forlorn, for, as the ASL just recently discovered, the building had actually been sold in 2010 for N100 million.

A quantity surveyor, Olamide Martins, described the sale sum as “a pittance” and estimated the cost of the property, even as far as back as 2010 and in its burnt shape, at “not less than N1 billion.” Another estimate put the worth of the building at N1.5bn.

The ICIR checks revealed that the sale might well be one of those a House of Representatives committee constituted by the Speaker, Femi Gbajabiamila, is probing over allegations of sleaze.

ASL, which claimed that it had spent huge sums of money on the building to put it in good shape while managing it, is accusing the FRCN management of hiding the fact that it had been sold while maintaining the leasehold arrangement with it right up till the 2019 fire incident.

But the Director-General of the FRCN, Mansur Liman, in an interview with The ICIR, washed the corporation’s hands off the transaction, saying that it was not in any way involved and was, in fact, oblivious of the transaction until this year when a letter from the ASL indicated the property had truly been sold.

Habeeb argued that the building could well have collapsed after it suffered the first fire shock in 1997 “when the FRCN neglected it but the ASL intervened with the leasehold idea and effected extensive repairs and renovation on it.”

The lease agreement gave the ASL, which was itself a tenant there occupying two big shops, the approval to “reinforce the structure of the (burnt) building and undertake renovation of the second floor damaged as a result of the fire incident, including replacement of the floor and ceiling; restoring the walls, and doing plumbing and electrical works, and repairing the elevator house; and effecting a facelift of the whole building, including interior and exterior to the satisfaction/approval of the Lessor or his authorized consultant as contained in the Works specification in Schedule ‘A’.”

Habeeb estimated the renovation job as costing the company a sum of N30m. He said Adebowale, who died in December 2008, was willing to expend such a huge amount on the building’s renovation because he envisioned the federal government, through the FRCN, could put up the building for sale any time and his company would be accorded the right of first refusal to buy it.

The business relationship between lessor and lessee continued after the formal agreement expired, with the FRCN granting ASL another one-year agreement to keep managing the property on its behalf, including collecting rent from the tenants, ensuring the structure was spick and span, and be responsible for electricity bills payment.

Whereas the first five-year lease agreement entailed the lessee paying the FRCN the sum of N3.5m annually, the new agreement jacked the payment up to N13m. Although there was no formal agreement after that, the business relationship between the two parties continued along the same terms and with another N2m added to the remittance sum, until the November 2019 fire incident rocked the boat.

Habeeb disclosed that the annual rent on the estimated 100 shops in the property ranged from N200,000 to N300,000 per shop, but lamented that the cost of maintaining it, including buying a transformer to ensure power supply solely for the use of the tenants, was astronomical and always ate into whatever profit the company made from the lease. Moreover, the lessee explained, it could not utilize the three top floors of the building as potential tenants were unwilling to accept them because the massive structure had no lift that could ease mobility to the top floors.

To indicate the lease agreement between the two parties was still subsisting, even if informally, Radio Nigeria Investments Limited (RNIL), the business entity directly relating with the ASL on the lease agreement, conveyed its intention in 2019 to increase the annual remittance by ASL to N25m, from N15m. But the ASL management pleaded, in a correspondence dated February 26, 2019, with the lessor that the increase be deferred for economic reasons, including “the fact that some tenants go for months on end without paying rents.”

The Director, RNIL, Mike Yahweh, wrote on March 19, 2019 to Aribike Arigbabu, the ASL Managing Director and daughter of the late owner, a letter titled, ‘Re: Increase In Rent On Lease Of 45, Martins Street, Lagos’, stating that after reviewing the reasons adduced by the ASL on why the increase should be deferred, Radio Nigeria had decided to increase the rent to N20m per annum, with effect from March 3, 2020. The letter advised ASL to strive and utilize the vacant three top floors of the building to enable it recoup its investment.

Nine days after the second fire incident in 2019, the ASL wrote to RNIL seeking approval for the company to conduct an integrity test on the burnt building “without further delay.”

Habeeb pointed out that the test had “become imperative in the light of similar tests carried out by the relevant Lagos State building department and to further highlight our belief that the stability of the building has not been tainted/compromised by the loss of some columns and the after-effect of the inferno.”

As Habeeb feared, the Lagos State government conducted its integrity test on the building shortly after ASL’s letter to RNIL. On November 19, 2019, the state Ministry of Physical Planning and Urban Development, through M. A. Balogun, Head of its Technical Services Department, informed the ASL, whom it described as “the owner/developer” that its test and investigation showed that “the strength of majority of the structural elements has been jeopardised and the building is no longer fit for habitation and constitutes a threat to lives and properties.”

The ministry then directed the “owner/developer” to “re-engineer the building under the supervision of a qualified engineer immediately to save lives and properties.”

The ASL management forwarded the original copy of the ministry’s letter to Yahweh on December 11, 2019, emphasising the re-engineering recommendation. Radio Nigeria’s response to the sale rumour was to commence running a jingle on all its stations in Nigeria warning the public that the building was not for sale.

The jingle, issued as a “PUBLIC ANNOUNCEMENT”, informed the “general public that the six-storey building known as RN2 situated at No. 45, Martins Street, Lagos, belongs solely to the Federal Radio Corporation of Nigeria.” The announcement emphasised that the said property was not for sale and had not been sold to anybody, and that “Radio Nigeria, being the bona fide owner of the said house, is not contemplating selling it now, or in the near future.”

The public announcement, which was aired up till March 2021, would seem to give the ASL some confidence that the building had not been sold and the FRCN management had, indeed, not put it up for sale.

ASL officials would, however, be shocked on Sunday March 1, 2020 when they observed that a developer had encroached on the property and barricaded it with aluminum sheets, as well as invited armed policemen to guard the premises.

When the ASL security personnel at the site interrogated the developer, he calmly responded that the 45, Martins Street, Lagos property had been sold to his client.

The FRCN management, however, restored hope to ASL by debunking the sale claim and drafting policemen to the premises to douse the tension and anxiety that had gripped the lessee and traders.

Assured by the denial, Habeeb, on March 3, 2020, wrote to the FRCN DG through the then Director, Lagos Operations, Mr Adeyinka Amosu, appealing that the management and board of the corporation expedite action on effecting restoration works on the building.

The ASL was not the only worried stakeholder. On March 17, 2020, a body calling itself ‘Traders Association of 45, Martins Street, Lagos Island’ sent an appeal to the FRCN DG, through Mrs Arigbabu, “for the urgent restoration of 45, Martins Street, Lagos.”

In the letter, the traders, represented by their chairman, Lateef Omitunde and secretary, Kehinde Ajikanle, lamented that their businesses had suffered colossal losses since the fire incident: “In fact, most of us can barely take care of our families and pressing necessities of life as our daily bread is tied to the various businesses we carry out at the above-subject property.”

The traders expressed disappointment with the FRCN board members for allegedly failing to fulfill the promise they were said to have made on quickly restoring the property when they visited the burnt building on inspection last year so the traders could resume business.

“Regrettably, however, nothing has happened following the visit and we are still unable to conduct business on the property,” the traders stated.

Omitunde, who, along with his wife, had two shops in the burnt building, told ICIR that he lost N30m worth of goods in the inferno. He added he had been reduced to a roadside trader in the area, hoping for a miracle.

Also, Ajikanle now displays whatever is left of his wares by the Martins Street roadside after he lost goods he estimated at N50m to the fire. The association’s secretary, an importer of shoes and clothing materials from China and Dubai, lost four shops in the building.

“Life has never been the same since we lost everything to the inferno. We thought the FRCN Board will come to our rescue when they visited the property last year only for us to hear that the property has been sold. Life has been difficult,” he said.

Ajikanle was amazed that even the FRCN board, under the leadership of Mallam Aliyu Hayatu, that visited them last year at the burnt premises and assured them of quick repair of the building would claim ignorance of its sale. Our reporter learnt that a bureau de change operator with an office in the building, identified as Alhaj Abdulmalik, collapsed and died after losing lots of foreign currencies in the fire tragedy.

The ASL reinforced the association’s position with its own letter signed by Habeeb and dated March 18, 2020 to the FRCN DG highlighting the heavy toll the permanent closure of the building had had on the company’s business and those of the tenants.

It stressed that the building’s dilapidated state underscored the urgency for its reengineering as “the Lagos State Physical Planning Department was waiting, in any eventuality, to repossess it.”

The ASL got agitated once again when it observed the activities of “unknown people armed with dangerous weapons” on the premises. Habeeb, in a letter dated November 17, 2020, reminded Dr Liman that in an earlier missive, he had informed him that the invaders claimed they were there because their principal had bought the property. He added that the “hoodlums completely vandalized the building by removing and carting away steel doors of all the shops and window frames.”

What the ASL management found confusing was that, as Habeeb pointed out in his letter, the FRCN had on November 26, 2020 erected a signpost at the site affirming that the building remained the corporation’s property and warned of any trespassing.

The ASL appealed to the FRCN boss “for the umpteenth time” to “in the light of the above, carry out the rehabilitation of this property.” The company offered its willingness to do the “complete reengineering and rehabilitation of the property as prescribed by the Lagos State Ministry of Physical Planning and Urban Development” if approved by the FRCN management.”

In April this year, what seems to be the truth about the 45, Martins Street, Lagos Island property unequivocally emerged. On Monday 26, 2020, ASL personnel once again saw some men at the site who declared, when confronted, that they were representatives of the buyer and had come to start rehabilitation works.

“To support their claim this time, they produced documents showing sale of the property to Messrs Seamen Traders Nigeria Limited (STNL) as far back as 2010 via the Presidential Implementation Committee on the Sale of Federal Government Assets,” Habeeb told the ICIR.

Shocked by the documents, the ASL management made efforts to confirm the development from Liman and some other principal officers of the FRCN but were not immediately availed any clarification. Amosu would eventually confirm the sale in a telephone conversation Habeeb had with him.

Jolted, ASL, in a letter its company secretary sent to the FRCN on May 17, 2021, expressed its displeasure at what it described as “the injustice” the FRCN meted out to it.

The company stated, “It is on record that ever since the fire disaster that engulfed 45, Martins Street, Lagos Island on November 6, 2019, we have lost a colossal sum and we have always remonstrated this via our several correspondences to your good self up to the period leading to the visit of the Board of the FRCN and beyond. Up till now, there hasn’t been any official response from the FRCN concerning the sale.

“Respectfully, sir, I think we deserve better. For the avoidance of any doubt, it is trite law that we deserve the right of first refusal as a sitting tenant of over 40 years. This sale to another party is very painful and excruciating, to say the least.”

The letter reminded the FRCN DG that ASL “single-handedly” rehabilitated 45, Martins Street following the November 1997 fire. “Not only that”, the company continued, “we bought the transformer presently serving the building, partitioned the property to shops, installed spiral staircase, paid a humongous amount for the non-destructive integrity test to the Lagos State Ministry of Physical Planning and Urban Development on the building following the fire incident, rehabilitated the penthouse roof and restored and installed so many other facilities too numerous to mention.”

The letter urged Liman to recall that the FRCN board empathised with the company and other tenants when members visited the burnt building last year and promised to assuage the yearning and aspirations of the traders “without further delay.”

FRCN wouldn’t have continued ownership claim if it knew building had been sold – FRCN DG

Liman, while expressing his sympathy for ASL and the tenants at the RN2 building over their plight, maintained that he and the entire FRCN management were unaware of the sale of the property, until March this year.

“We didn’t know that that building had been sold by the Presidential Implementation Committee responsible for selling off federal government’s assets. Up to that moment, we believed 100 percent that that building belonged to the FRCN. And that was the reason we erected a signpost when Adebowale told us that some people were encroaching the building claiming it had been sold to them:

“So we went there and erected that signboard because we believed 100 percent that that building at that time belonged to the FRCN. We also went again to use our airtime to say this building belongs to the FRCN. If we knew that building didn’t belong to the FRCN, why would we go to that extent to claim it did?”

The FRCN DG said it was at that time that the FRCN received a letter from Seamen Traders claiming that it bought the property “way back” in 2010 from the committee responsible for selling government’s property.

“When we received the letter, we wrote to the Presidential Implementation Committee (PIC) in charge of disposing of federal government’s property to ascertain that the letter was genuine. They wrote back to us to confirm it was genuine and the transaction was done in 2010. They certified they issued and attached a Certificate of Occupancy. It was at that time we realized the building had, indeed, been sold. When we realized that, we wrote to Adebowale to inform them of the development. We told them the Presidential Committee is a government committee and we had received a confirmation that the building had been sold. It would at that point be illegal for us to claim that the building belonged to the FRCN,” he said.

Adding that the FRCN management then approached the Minister of Information to brief him on the issue, Liman wondered why ASL’s officials would be accusing the FRCN management of leading them up a blind alley – and for so long – regarding ownership of the RN2 property.

Yahweh said the FRCN received a letter from Seamen Traders Nigeria Limited (STNL) only on March 10, 2021 addressed to the Director-General notifying him that the property at 45, Martins Street, Lagos Island “belongs to our company, Seamen Traders Nigeria Limited.”

Seamen Traders claimed in the letter that the presidential committee duly sold the property to it, which it duly accepted on offer, in writing.

“We paid the purchase price in full and the receipt of payment was issued to us by the PIC, including payment for the documentation of the transaction. In confirmation of our company’s title to and ownership of the property, we have been issued the Certificate of Occupancy, dated 17th May 2010, to the property and registered as No. 35 at page 35, Volume 244 at the Federal Lands Registry.

“Copies of the Certificate of Occupancy, offer letter from the PIC, receipt of payment of purchase price and other relevant documents are hereby attached for your information and records. After the fire incident in the area which destroyed the adjoining property and affected part of our property, our company engaged the services of a reputable developer, Oguns Investment Nigeria Limited, to carry out extensive renovation and rebuilding of the property to restore its structural and aesthetic integrity. Please, be guided accordingly,” STNL stated in the letter signed by Prince Chidi Orji, a copy of which the ICIR possesses.

Liman said he was shocked by the content of the letter and decided to brief the Minister of Information, Lai Muhammed, of the development, as well as move to confirm STNL’s claim from PIC.

The FRCN, in a letter signed by Liman, wrote on March 16, 2021 to the Executive Secretary, PIC thus: “Re: Property situate at 45, Martins Street, Lagos Island. The above-named property, a six-storey building with a penthouse, belongs to the Federal Corporation of Nigeria, which has enjoyed uninterrupted possession until date. As a partially commercialised operation, it was rented out to Adebowale and Sons Limited for additional generation of revenue for the Corporation. The building was, however, gutted by fire on the 5th of November 2019.

“The Corporation is in receipt of a letter from Messrs Seamen Traders Nigeria Limited to the effect that they are now the owners having been offered the property by your Committee, paid for and issued with a Certificate of Occupancy dated 17th May 2010, which they have attached photocopies. The offer letter from your Committee indicates the property was sold for the sum of N100m. A receipt for the sum of N105m, dated 18th June 2010, is also attached as evidence of payment to the federal government. Our prayer: please confirm the authenticity of the offer and the acceptance and payment made to the PIC, and the genuineness of the Certificate of Occupancy.

“You may also avail the corporation with the process that led to this company being the preferred bidder as the building was still in the custody of the corporation as at the time of the offer and payment, so we can update our records.”

We sold 45, Martins Street 6-storey RN2 property for N100m – PIC

The PIC replied FRCN’s letter on March 24, 2021 stating that by selling the property, it acted on the instruction of the Federal Executive Council (FEC) based on its terms of reference and mandate. The PIC maintained that the sale transaction and all the documents the STNL attached to its letter affirming its ownership of the property were genuine.

“…the Committee has the FEC approval TOR and mandate “among other things, to implement all other measures which in the judgment of the Committee will assist the Government in achieving the object of deriving full benefits from its landed assets,” the PIC wrote in its letter, signed by Kola Adeyemi, the secretary of the Implementation Committee.

Attempts by the ICIR to get the PIC to respond to its findings did not yield fruits. The two phone numbers given on its letterhead were said to be non-existent when our reporter called them.

Also, a Freedom of Information Act (FOIA) request delivered to the PIC office in the Central Business District in Abuja, dated August 24, 2021 was acknowledged on August 27 but the body failed to respond to the request or provide the required information. The ICIR had requested for information on when the property was sold, for how much and proof of sale. More than two weeks after the request was made, there has been no response. The access to information provides a window of seven days for such requests to be answered.

The PIC activities have not been without scrutiny from the National Assembly and the Fiscal Responsibility Commission (FRC). The senate in October 2010, a few months after the PIC purportedly sold 45, Martins Street, approved the dissolution of the committee over alleged sleaze, including an alleged non-remittance of a sum of N1.2bn generated from the sale of government assets in Lagos and Abuja.

The recommended scrapping followed the senate’s approval of an interim report on its investigation into the sale of federal government’s landed property. Senator Ikechukwu Obiora, presenting the report to the red chamber, accused the PIC of giving undue advantage to some “privileged” Nigerians while rendering civil servants, whom he said should have been given the right of first refusal regarding the homes they had been occupying, homeless.

Senator Obiora also said the PIC “fraudulently” fixed the sum of N80bn, proceeds from the sale of government assets, with some banks at 2 percent interest instead of between 5 and 10 percent that the Accountant-General of the Federation approved.

“The PIC officials had under-the-table deals with the banks such that the lodgments were fixed at 2 percent interest, while the PIC officials had the difference paid to them as gratification,” Obiora alleged.

In June 2012, the FRC disclosed in a report that it had no financial records of property the PIC had sold. FRC stated in the report that its efforts to obtain records of transactions on the sale of houses from the PIC had been unsuccessful.

“So far, in spite of concerted efforts by the commission, there has not been any record of the sale of federal government houses. The Presidential Implementation Committee is not forthcoming,” FRC declared.

The ICIR gathered that the House of Representatives is also investigating the controversial sale of the RN2 building. Adopting a motion sponsored by Ademorin Kuye, member representing Somolu/Bariga, Lagos, the House, in October 2020, mandated its ad hoc committee on abandoned properties to conduct a thorough investigation of “federal government’s abandoned properties across the federation.”

The Speaker, Femi Gbajabiamila, constituted the ad hoc committee on May 12, 2020 for the purpose. Sponsoring the motion, Kuye indicted the Committee for lack of due diligence in the sale of government properties.

“The Presidential Implementation Committee on sale of federal government houses in Abuja and some ministries, department and agencies have not shown due diligence, transparency and accountability in the exercise of their respective mandates with respect to federal government properties,” Kuye had said.

The legislator accused the committees and MDAs of “wantonly balkanizing federal government assets with no commensurate remittances to the Federal Account without recourse to the oversight or accountability powers of the House or the Office of the Accountant-General of the Federation.”

When the ICIR spoke to Kuye on Thursday at the National Assembly Complex, he confirmed that the ad hoc committee on abandoned properties was investigating the sale of 45, Martins Street, among other properties owned by the FRCN.

The legislator, who declared that it was “criminal” to have sold the Martins Street building for N100m, said that the PIC had not been able to produce any evidence that proceeds of the sale of the property was ever paid into government coffers.

He told our reporter that in investigating the sale, his committee wrote to the PIC in September 2020 to provide information on when the property was sold, for how much and evidence of remittance of the proceeds of the sale into the federation account.

According to him, the presidential committee replied and provided other requested information but for any proof of payment of the N100m to the federal government.

“We did a letter to the Secretary (of PIC) on April 15, 2021, requesting them detailed information on the sale of that property, including date of sale, amount of sale, evidence of payment into the consolidated revenue account and other relevant information.

“On April 22, 2021, they replied us saying that before the present leadership of the PIC, the property was on May 17, 2010 offered for sale to one company, Seamen Traders Limited, with offices at 74, Iga Idugaran, Idumota, Lagos Island. But our request included evidence of remittance to the federation account. They did not include that,” he said.

The lawmaker added he subsequently mandated the clerk of the committee on sale of abandoned government properties “to direct the PIC to stop all processing of documents, all title documents in favour of any person or company with respect to this property (45, Martins Street) pending the investigation of this sale.”

Kuye said that members of the ad hoc committee were appalled to learn that the FRCN did not even have knowledge of some of the properties the committee discovered were owned by the corporation. He further said the committee members were also amazed that the FRCN DG was looking at a Public-Private Partnership, PPP, arrangement to rehabilitate 45, Martins Street after it got burnt in 2019, nine years after it was purportedly sold to Seamen Traders.

Hon. Kuye said that his committee would conclude the investigation on the sale of the FRCN property soon.

During our investigation, the ICIR saw some workers claiming to be representatives of Seamen Traders at the site in April. However, they have disappeared over the last two months and it is desolation at the broken edifice once again.

The ICIR could not locate Seamen Traders Nigeria Limited at No. 77, Ojuelegba Road, Yaba, Lagos mainland, the address listed online as its location.

Attempts to speak with Senator Kalu were not successful as calls made to two of his phone numbers were not answered. The ICIR also sent a message to Kalu vis WhatsApp asking him to confirm his ownership of Seamen Traders and the company’s purchase of the RN2 building. There is an indication that the message was delivered, but the politician had not responded as at the time of filing this report.

[Report by International Centre for Investigative Reporting, ICIR]

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)