...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

RE: ABIA FINANCIAL STATUS: SEPARATING THE FACTS FROM IKPEAZU’S FICTION

My attention has been drawn to the above titled publication by Governor Alex Otti, wherein he fruitlessly attempted to divert attention of members of the public and artfully avoided the issues raised in my widely circulated publication that elicited his latest response. Not only did it take him more than 5 days to conjure a response to what is fairly straight forward, he even opted to delve into his familiar field of political maraboutism by divining who will join which party as if everyone is struggling to break his infamous record of moving from PDP through APGA then APC before eventually perching in Labour Party. Sadly for him, not everyone is as restless as him, or even interested in venturing into the ignoble art of endless political turncoatism of which he is an expert.

As if that was not enough, the whole political establishment in Nigeria is already aware of his subterranean moves to dump Peter Obi and Labour Party to rejoin APC so as to attempt to survive his inevitable sacking by the tribunal.

No matter how much he howls and growls, Otti ‘s little veiled threat of unleashing anti-corruption agencies on Ikpeazu is both laughable and childish, especially coming from a man who has been their regular guest for decades yet the world did not come to an end.

Every leader must be ready to give account of his stewardship and when Otti exits his current office he will also have to give account to anti-graft agencies. Same way Ikpeazu is ready to give his.

For the avoidance of doubt, I will restate the issues I raised in my publication of 10th June 2023 titled “Is It True that Ikpeazu Left Nothing for His Successor?” Feel free to examine vis-à-vis the needlessly verbose beautiful nonsense that took the whole of Otti’s government five days to churn out.

1. I stated that “as at the time of Dr Okezie Ikpeazu’s exit from office, the state was not owing any commercial bank including temporary overdrafts. He paid off all.”

Those familiar with current commercial banking operations and DMO regulations will agree with me that state governments are not permitted to borrow beyond their tenure. That, I believe, was why UBA for example clamped on Abia State funds for the last two months of the Ikpeazu administration in order to clear the temporary overdrafts (TOD) owed them.

The commercial bank loans listed in the statement by Otti’s government were not obtained or signed off by the Abia State Government led by Dr Ikpeazu. From my investigation, what I believe happened was that those were mostly borrowings done by the Federal Government on behalf of the 36 states of the federation, and it’s either Otti wants to mislead the world into believing that it was Governor Ikpeazu that took the loans or he just wants to desperately deny Abians the true amount left for him in Abia coffers by the former governor.

I hereby challenge Otti’s government to publish application and approval documents for the listed loans so we can all see the truth, the whole truth and nothing but the truth.

When the federal government borrowed from CBN and gave bailout loans to states, it was only Ikpeazu, among all the benefitting states, that set up a Labour-led committee to disburse the money. Indeed, ICPC and NGF applauded him for the prudent management of the funds having monitored same.

2. I also stated that “ Abia State under the watch of Dr Ikpeazu invested $5,000,000.00 in Geometric Power Company. That’s a near cash asset. ”

Happily, Otti’s government did not deny this fact in their statement. For the avoidance of doubt, $5m is equivalent to at least N3.76b today at black market rate, and since the government did not deny this, we can safely conclude that they have confirmed the existence of the near-cash investment I mentioned.

3. “As at Friday, 9th June 2023, 11 whole days after Otti became Governor, Abia state received the sum of Twenty Four Billion Naira (N24,000,000,000.00) through the Nigeria Governors’ Forum as part of a total of N48b standing to the credit of the state. The money was earned under the watch of Dr Ikpeazu but paid the State under the watch of Otti.”

Rather than admit to the people of Abia State that they actually received a whooping Twenty Four Billion Naira on the date I clearly stated, the Otti administration chose to publish purported balance as at 28th May 2023. Abians must insist that the administration confirm that they have received the N24b as we are already hearing rumors of plans to use the money to settle campaign debts and compromise election petition judges.

It is important to emphasise the fact that other states got the same money from the Nigerian Governor’s Forum as Abia with the state credited to the tune of N24b out of N48b earned under Ikpeazu’s watch.

I therefore challenge Otti’s administration to publicly state without equivocation that they have not received the money, as I stated, so that we, as citizens, can use legal instruments to compel the concerned bank and institutions to respond accordingly.

Furthermore, according to them, the Ikpeazu administration left a liability of N21b in pensions and N4.4b in contractor debt. I wish to plead with the government to use the N24b and pay off those two debts substantially since the liabilities and assets were earned by the same administration. That is just common sense.

4. “Ikpeazu’s administration perfected a Fifty Million Dollars ($50,000,000.00) World Bank facility at 0.06% interest rate with 10 years repayment moratorium for construction of more than 500km roads including Port Harcourt Road, Aba. The implication is that the current administration can commence drawing down on that facility from day one to construct critical roads in Abia State and will not have to repay the money over the pendency of its tenure, assuming it is up to 8 years.”

In their response, the government claimed that, “The $200m and $50m they claimed they left for the new administration are loans they were pursuing which are yet to crystalize.”

Interestingly my publication clearly stated that they are loans and even gave the repayment terms. Whatever they mean by “yet to crystalize” will be made clear to all very soon. As far as I know, Governor Ikpeazu was scheduled to flag off the road projects listed in the $50m facility two days to his exit from office but decided to leave it for his successor to “use in hitting the ground running”. When the administration finally sees whatever “crystal” they are looking for, I hope they will appropriately give credit to Ikpeazu who worked on the facilities from start to finish.

5. “While the Ikpeazu administration superintended over the state for most of May 2023, it is the current administration that will receive the FAAC allocation for that month.”

Interestingly, Otti’s government tactfully dodged this, too, in their response. But I know for a fact that they have already moved to receive this allocation. As soon as the funds drop, I will alert Abians as part of my social responsibility just like Ekeoma and Otti were doing while they were in opposition for 8 years.

6. “Similarly, internally generated revenue for the month of May 2023 is also available to the new administration.”

According to the Otti administration, “Poor internal generation of revenue, with the little they generated frittered away in payment to consultants for no added value. They pay as much as 20% which is highly unethical.”

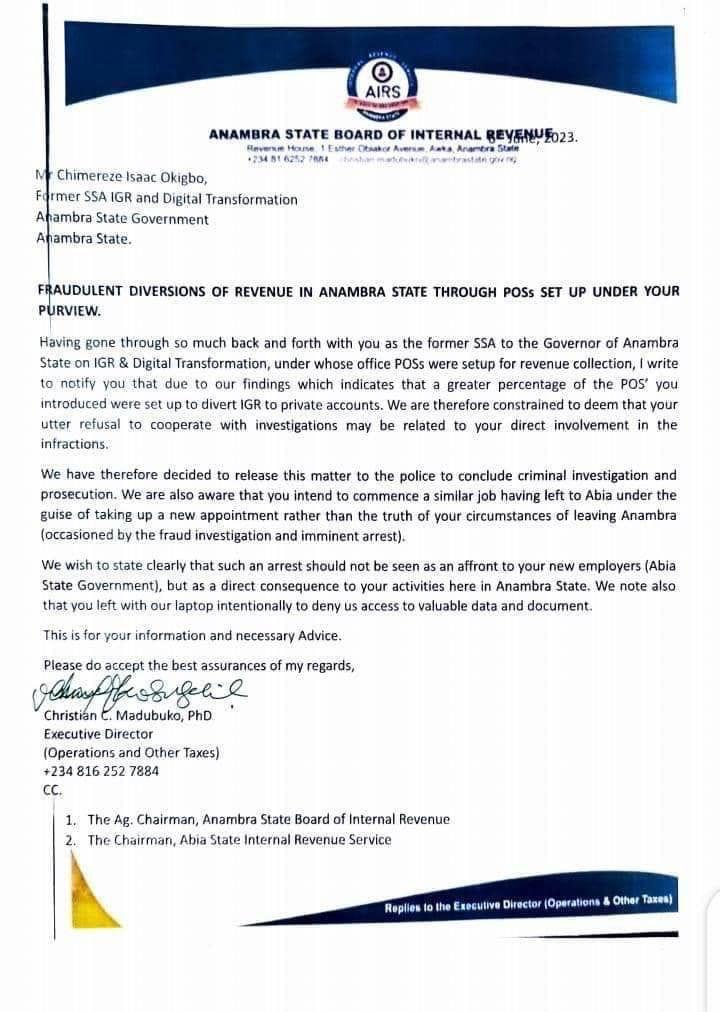

As we have now seen the administration has engaged in “ethical” practice by hiring someone indicted by Anambra State Government for fraud with the police directed to arrest him, and for the reason that, “a greater percentage of the POS’ you introduced were set up to divert IGR to private accounts”, to manage our IGR. While Abians are waiting to learn who owns the private account and the bank allegedly used for the Anambra sleaze, suffice it to state that it is better to pay consultants 20% than to hand over the whole IGR to someone that will divert all our IGR to private accounts as Anambra experienced.

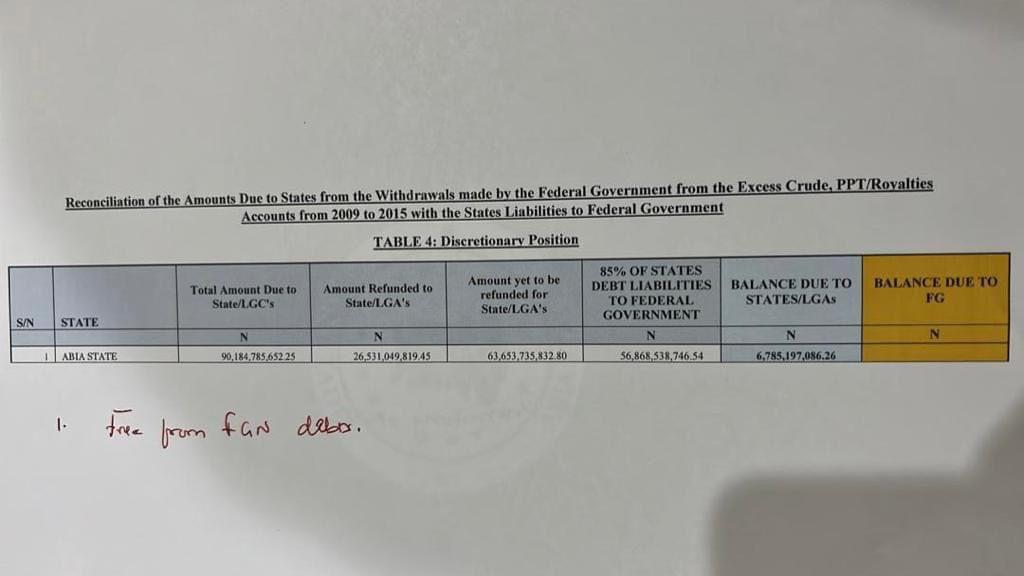

7. “Prior to the exit of Dr Okezie Ikpeazu from office, Abia State Government and Office of Accountant General of the Federation reconciled their accounts with Six Billion Naira (N6,000,0000,000.00) standing to the credit of the state. What that also says is that the Ikpeazu administration was not owing federal government but rather it is the FGN that is owing the state. The current administration has access to that additional fund of N6b.”

Did anyone read where the administration denied this fact in their response? Not at all. Why? Because it is true. Undeniable!

For the avoidance of doubt, Otti’s government is set to receive this amount this month alongside the regular monthlyFAAC allocation to the state. Yet, he won’t give credit to Ikpeazu for it because of his bitterness and hatred for the man simply because he defeated him twice at the polls, a reality he is yet to recover from.

8. The listing of gratuity arrears of N27b is as deceptive as the whole statement from the administration. According to a recent public statement by Abia NLC, since 2001, successive Abia State Governments have not paid gratuities but to continue to mislead the public, the current administration wishes to mischievously present the total arrears as if they all became due under Ikpeazu. If anything, I know the Ikpeazu administration paid at least N100m as gratuity during the period Obinna Oriaku was Commissioner for Finance.

9. Just seeing one of the captured items in Otti’s response has double triggered my worries about the “one chance” bus Abians have boarded. Please, Otti’sgovernment, publish the details of what you called “SALARIES AND SUBVENTIONS ARREARS” so that Ndi Abia can see the make up. Rats cannot steal the food of a man that is awake, hence, no body should use smart terms to confuse and confound ndi Abia to enable convenient stealing of our resources.

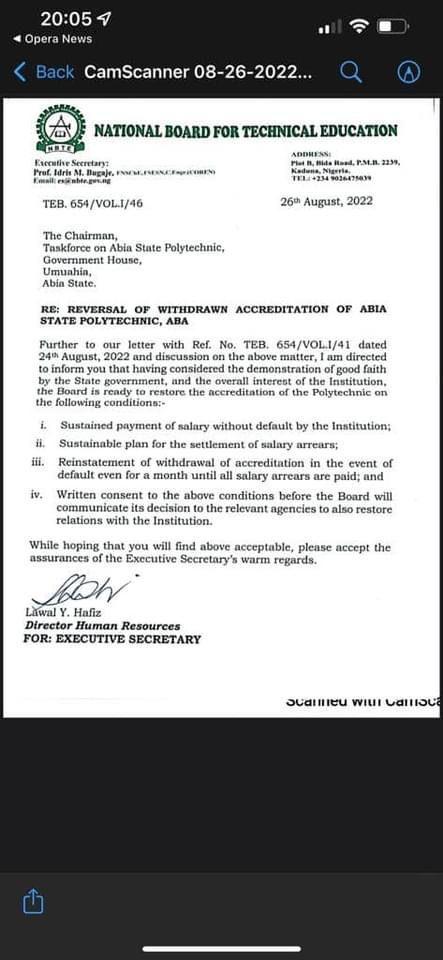

10. For whatever it is worth, let me remind Governor Alex Otti that it was his same bitter self that manipulated and instigated multiple strike actions in the state leading to withdrawal of accreditation of the institutions he mentioned just to score cheap political points. Yet, to the glory of God, accreditation was long restored to those institutions before the exit of Governor Ikpeazu.

11. If they think that we did not know that it was Alex Otti that reportedly instigated Labour Unions and used industrial action to play politics in the state, then they are deceiving themselves because, in due course, he will reap whatever he sowed unless he repents and confess to the nocturnal meetings, phone calls and financial inducements.

12. If they are still saying that there is no $200m AfDB facility, I wish to encourage the signatories to ask Otti about the same loan he worked so hard to stop including traveling to London to meet Senator Sani to plead that the facility be withheld from Ikpeazu’s administration till he is elected. That same loan he confirmed to journalists that he stopped was in actual fact only delayed in accordance with his request as it became ready to be drawn on before the exit of Ikpeazu. Otti’s government must give Ikpeazu credit for the work he did or publicly decline the loans as supposed better administrators.

13. Finally, my guess is that it took Otti’s administration so long to respond to the issues I raised concerning Abia’s financial status as bequeathed by Ikpeazu because, either they had no knowledge of the issues, or they were too complicated for them to understand because they had flatly denied the issues on some platforms they were published.

14. Let me make it abundantly clear to Otti and his aides that there is nothing hidden in government and, they should be transparent and honest to Abians. At least, that was what they promised the people.

15. Lastly, the threat and use of EFCC to intimidate anyone is a frutiless tactic deployed just to make media noise. No one as innocent as former Governor Okezie Ikpeazu, PhD, can never be intimidated with the threat of EFCC. Try as hard as they may, nobody can foist a dictatorship on Abians! The art of threatening every dissenter or attempt to cow alternative voices is no longer in vogue as Nigeria keeps making progress on her path to democratic sophistication.

16. We are very much aware of the meeting Ferdinand Ekeoma, Otti’s Special Adviser on Media and Publicity, had with Abia bloggers two days ago to fund “6 months of attack against Ikpeazu” and decided to watch until the attacks start. Let me state clearly that since Otti wants to run his government on falsehood, mischief, malice and strife, we are very much prepared for him and his team. Nobody in this state is more Abian than the other.

17. While we want to believe that Otti’s response to my initial article is a subtle commencement of the planned attacks against Ikpeazu given the EFCC dimension to it, we wish to remind those concerned that those who pelt another with pebbles should expect rocks in return.

Ikechukwu Iroha

Former Media Aide to Governor Ikpeazu

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)