...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

Heritage Bank for being part of valuable private sector collaboration with Dukia Gold & Precious Metals Refining Co. Limited is set to unlock the over N344trillion market worth of gold investible instruments in the solid minerals sector with the concluded plans of being listed on the Lagos Commodities and Futures Exchange (LCFE).

This move that will entrench expand revenue in the non-oil sector through diversification, by stimulating growth in solid minerals in line with the objectives of Economic Recovery and Growth Plan (ERGP) will also put Nigeria on the global map with regards to standardized gold tracing, sourcing procurement and trading it.

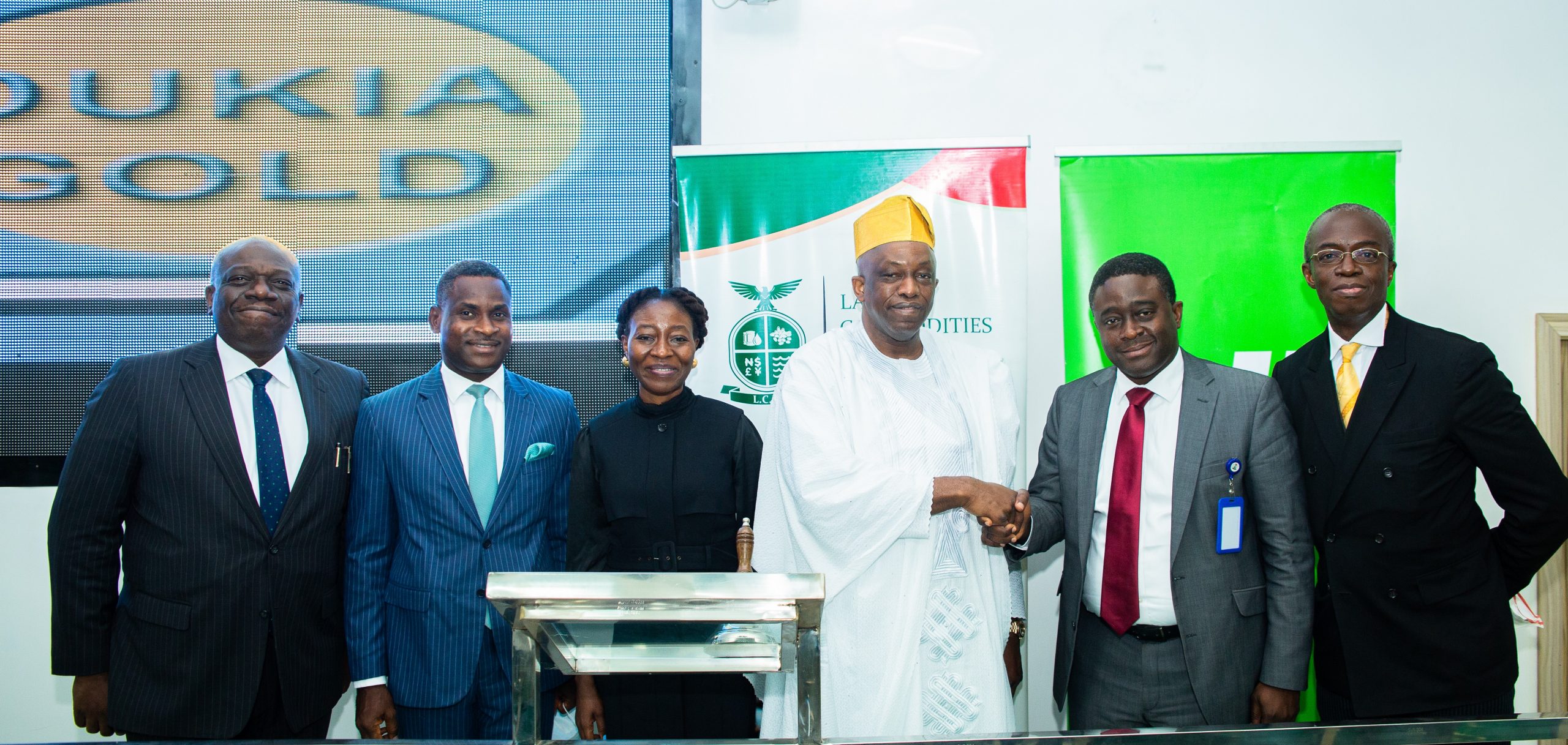

In summary, this was disclosed at the LCFE-Dukia Gold media parley held yesterday at the LCFE Trading Floor in Lagos.

Speaking at the parley, the Chairman of Dukia Gold, Tunde Fagbemi who commended Heritage Bank as the project financier and for its other pertinent supports, said Heritage had so far been the banker’s bank for playing key role in backing to promote the first solid mineral listing on Exchange in West Africa.

Specifically, he explained that the instruments which would be in the form of Exchange Traded Notes (ETN), Commercial Papers (CP), and other gold-backed securities would enable the company to deepen the commodities market in Nigeria. He added that it would increase capacity, generate foreign exchange for the government to diversify external reserves and create massive employment across the metal production value chain.

“We are proud to be the first gold company whose products would be listed on the Lagos Futures and Commodities Exchange. The listing shall enable us facilitate our infrastructure development, expand capacity and create fungible products.

“This has potential to shore up Nigeria’s foreign reserve and create an alternative window for preservation of pension funds.

“As a global player, we comply with the practices and procedures of London Bullion Market Association and many other international bodies. “Our refinery will also have multiplier effects on the development of rural areas anywhere it is located. “There must be constant power supply, good road network and other social amenities, apart from employment opportunities for the rural dwellers,” Fagbemi explained.

He also noted that with its current 25 production capacity pound and further room for expansion, Dukia Gold has the ability to meet both local and international demand through its gold refinery services to smelt melts.

Commenting on the collaboration, the MD/CEO of Heritage Bank Plc, Ifie Sekibo said that the partnership was one of the many initiatives of the bank’s foundational objectives of wealth creation, preservation and transfer across generations.

He further disclosed that the bank offer the gold commodity market three focal contact point in partnership, knowledge and perspective sharing, which ensure that every transaction was auditable to protect investors.

Sekibo who was represented by the Divisional Head, Strategy and Business Solutions, of the Bank, Olusegun Akanji, said the bank had created a buying centre for verification of quality and quantity of gold and reference price to ensure price discovery in line with the global standard.

Speaking, the MD, LCFE, Akin Akeredolu-Ale, who also commended Heritage Bank for its critical role in aiding the fundraising and the financier institution for the Dukia Gold’s diversified financial instruments, affirmed that this would enhance the company credibility rating and put Nigeria on the global map.

He noted that the LCFE was ready to support all the stakeholders in the gold sector in the areas of market creation, price discovery, and dissemination of market information, among others.

|

|

Gbenga Awe, Divisional Head, Agribusiness, Natural Resources & Project Devt., of Heritage Bank noted that one of the benefits of this initiative was that the local miners could now trade their gold at the bank’s designated experience centers, as solid foundation had been created for market, price and asset discovery.

Akintola noted that the firm had the capability, technicalities and the necessary accreditation to operate in the gold value chain.

He stated that the listing on the Lagos Commodities would raise awareness of performance of Dukia Gold to the investing world and position it as foremost number one Precious Metals Refining Company in Nigeria.

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)