Court processes sighted by THISDAY, which have not been verified, have shown details of how the $1.1 billion paid by Shell Nigeria Ultra-Deep (SNUD) Ltd, Shell Nigeria Exploration and Production Company (SNEPCO) Ltd and Nigerian Agip Exploration (NAE) Ltd to the federal government in 2011 for the purchase of Oil Prospecting Licence (OPL) 245 originally held by Malabu Oil and Gas Limited was shared by some prominent Nigerians.

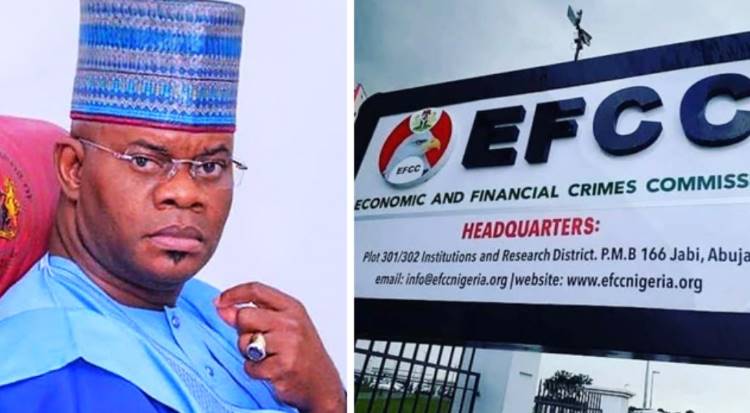

This is just as a Federal High Court in Abuja has fixed April 3 for the arraignment of the former Attorney General of the Federation (AGF) and Minister of Justice, Mr. Mohammed Adoke, a former Minister of Petroleum Resources, Chief Dan Etete, and others charged with various alleged offences for their roles in the transaction.

According to court papers, a son of the late military Head of State, Sani Abacha, Mohammed, and a known associate of former President Olusegun Obasanjo, Oyewole Fasawe, gave details of how OPL 245 was allegedly taken from them and sold to the SNUD, SNEPCO and NAE consortium in 2011.

They also provided insight into how the $1.1 billion paid by the consortium for OPL 245, which was facilitated by the Nigerian government, was shared by some prominent individuals, without the knowledge and involvement of a majority of the actual owners of Malabu Oil.

Abacha and Fasawe equally gave details, in their joint plaintiffs’ statement of claims, in a suit they recently filed at the Federal High Court, Abuja, of the roles allegedly played by former Ministers of Petroleum, Justice and Finance – Etete, Adoke and Yerima Lawal Ngama, respectively – in the transaction leading to the sale of OPL 245 and the lodgment of the proceeds from the deal in the federal government’s escrow account.

The Economic and Financial Crimes Commission (EFCC), in a court document filed earlier this year, had stated among other things that Malabu Oil was incorporated in Nigeria sometime in April 1998 with shareholders, namely: Mohammed Sani (fronting for the late Gen. Sani Abacha), Kwekwu Amafegha (representing Dan Etete, then Minister of Petroleum Resources) and Hassan Hindu (on behalf of Ambassador Hassan Adamu.)

The commission stated that in the same month, the Ministry of Petroleum Resources offered Malabu Oil a deepwater oil block processing licence in respect of OPL 245.

EFCC said that upon the death of Gen. Abacha in June 1998 and between 1999 and 2000, the corporate status and shareholding structure of Malabu Oil were altered severally through forged board resolutions, which eventually divested Mohammed Sani of his shares while new shareholders and directors were appointed fraudulently.

In their court documents filed on March 20, 2017, Abacha and Fasawe, who claimed to own a 70 per cent stake in Malabu Oil, said they were fraudulently divested of their shares.

The suit has Malabu Oil and Gas Ltd, Mohammed Sani and Pecos Energy Ltd as plaintiffs, with Kweku Amafegha, Munamuna Seidougha, Amaran Joseph, Corporate Affairs Commission (CAC), Shell, Agip, Federal Government of Nigeria (FGN), AGF, and the Petroleum Minister as defendants.

The plaintiffs stated that at inception, Malabu Oil’s equity holding of 20 million was shared among its initial subscribers thus: Mohammed Sani: 10 million (equivalent of 50 per cent), Kweku Amafegha: 6 million (30 per cent) and Hassan Hindu: 2 million (20 per cent).

They said Hindu’s 20 per cent was later bought in 2000 by Fasawe through his company, Pecos Energy Ltd.

They stated that while Abacha was imprisoned between 1999 and 2002 and could not actively participate in the affairs of Malabu Oil, Chief Dan Etete (also known as Chief Dauzia Loya Etete), the consultant to the first plaintiff (Malabu Oil) whose function was in an advisory capacity, took over the first plaintiff’s books, documents and records in the absence of the second plaintiff (Mohammed Sani) without any mandate to do so.

The plaintiffs further stated that sometime in 2010, they learnt of some fraudulent alterations of the shareholding structure of Malabu Oil in its files with the CAC, purporting to divest the three original shareholders of their investments in Malabu Oil and allegedly making Seidougha and Joseph the only shareholders and directors with 10 million shares each.

They added that upon realising the alleged fraudulent alteration of the company’s share structure and the plan to sell its core asset, OPL 245, they wrote a letter dated May 24, 2011 to then AGF, Adoke, “Complaining of the fraudulent alteration of the shareholding structure of the first plaintiff and the need to prevent the conclusion of the transaction in respect of OPL 245.”

They added: “Sometime in April 2011, SNUD, SNEPCO and NAE entered into a negotiation and allegedly bought over the assets of the first plaintiff, OPL 245, through the second and third defendants (Seidoougha and Joseph) and Chief Dan Etete acting as the two directors and consultant respectively of the 1st plaintiff, for a consideration of about $1.3 billion with the Federal Republic of Nigeria acting as an obligor.

“The said transaction was carried out through a series of agreements signed and dated between 29th and 30th April 2011 by Seidougha Munamuna purportedly acting as a director of the first plaintiff and Mr. Rasky Gbinijie purportedly acting as company secretary of first plaintiff, with the fifth, sixth and seventh defendants – Shell, Agip and FGN.”

They stated that conscious of the possible consequences of their (plaintiffs’) complaints and protests about the alleged illegality of the transaction leading to the sale of OPL 245, Shell and Agip “requested the involvement of the FGN as a form of guarantee and security for the investment they sought to engage in”.

The plaintiffs said: “Following the execution of the several agreements, $1,092,000,000.00 was paid into a Federal Republic of Nigeria Domiciliary Escrow Account No: 41454193 domiciled in JP Morgan Chase Co., London to be passed to the first plaintiff as consideration for the alleged surrender of its asset – OPL 245.

“On 16th August 2011, the FGN through the then Minister of State for Finance, Dr. Yerima Lawan Ngama and the AGF, Mohammed Bello Adoke (SAN) instructed the release of the money from the said Domiciliary Escrow Account of the FGN in the following manner: $401,540,000 paid into Account No: 2018288005 purportedly belonging to the first plaintiff in First Bank of Nigeria Plc, and $400,000,000 paid into supposed first plaintiff’s account No: 3610042472 with Keystone Bank Limited.

“Out of the $1,092,000,000.00, the sum of $801,540,000 was paid into the first plaintiff’s account with First Bank of Nigeria Plc and Keystone Bank Limited allegedly opened and run by the first plaintiff, yet Chief Dauzia Loya Etete (aka Chief Dan Etete) is the sole signatory to the two accounts.”

On how the money was eventually shared, the plaintiff stated that on August 24, 2011 when the Keystone Bank account, of which Etete was the sole signatory, was credited with $400 million, $336,456,906.98 was transferred to Account No: 1005556552 allegedly owned by Rocky Top Resources in Keystone Bank, Abuja CBD branch.

They added that the balance of $60,000,000 was transferred to account No: 3610042596 for forex trading.

The plaintiffs, who stated that Rocky Top Resources Ltd was owned by Abubakar Aliyu and Bashir Adewumi, explained that the money transferred to the Keystone Bank account was further transferred to other unnamed individuals, leaving a balance of $171,135,960.63.

They also stated that the $401,540,000 paid into the First Bank account, was distributed as follows:

• A Group Construction Co. Ltd. (owned by Abubakar Aliyu and others) of No. 2378 Limpopo Street, Maitama was paid $157 million.

• Mega Tech. Engr. Co. Ltd. (owned by AVM Nura Imam, Bashir Galandashi and others of 14C Durbin Katsina Road, Kano) got $180 million.

• Imperial Union Ltd of Plot 14 Wempco Road, Ikeja (owned by Omochonu Josef and Adeyemi Adeyinka) got $34 million.

• Novel Property and Development Ltd of No. 22 Capitol Road (owned by Adesegah Moses, Abubakar Aliyu, Adeyemi Tunji and Suleiman Ibrahim) got $30 million.

The plaintiffs added that by the statement of account of Rocky Top Resources Ltd’s Account No: 1005556552 in Keystone Bank, a transfer of $54 million was made to Bombadier as payment for the purchase of an aircraft.

They further stated that none of the persons listed as having been paid from the proceeds of the sale of OPL 245 sale rendered any known service to Malabi Oil and that no aircraft has been delivered to date.

The plaintiffs noted that at the time of the transaction leading to the payment of the money, the first plaintiff operated from the offices of Mr. Rasky Gbinijie on the 3rd Floor of No. 30 Catholic Mission Street, Lagos.

They added that it (Malabu Oil) has no office notwithstanding the $401 million allegedly received by it.

“The first plaintiff’s purported Account No: 1040659338 in Keystone Bank Plc to which the proceeds of the alleged surrender of the first plaintiff’s OPL 245 was paid, has as its sole signatory one Chief Dauzia Loya Etete, who is neither a shareholder nor a director of the first plaintiff and it is the said Chief Dauzia Etete that frittered away the whole proceeds paid to the first plaintiff,” the plaintiffs said.

None of the defendants has responded to the suit while the case is yet to be assigned to a judge for hearing.

Meanwhile, Justice John Tsoho has fixed a new date for the arraignment of Adoke, Etete and others for alleged corruption, after the EFCC failed to turn up in court last Thursday when the two charges it filed against the accused involved in the Malabu deal were mentioned.

None of the defendants was also represented in court.

An official of the court later drew the judge’s attention to a letter from the EFCC seeking an adjournment to enable it tidy up some issues regarding the case, in view of the fact that most of the defendants were said to be currently outside the court’s jurisdiction.

Justice Tsoho acceded to the request by the EFCC and adjourned to April 3 for possible arraignment of the defendants.

Shell, Agip, Adoke, Etete and others have been charged to court by the EFCC over alleged corruption involving the sale of OPL 245.

Agip’s parent company in Italy, ENI, and its CEO are facing similar corruption charges in Italy.

After obtaining a temporary forfeiture order on OPL 245 to the federal government, EFCC’s attempt to get a permanent forfeiture order on the oil lease was blocked recently when the court ordered that the oil block be returned to Shell and Agip.

Society7 years ago

Society7 years ago

Society4 years ago

Society4 years ago

News and Report6 years ago

News and Report6 years ago

News and Report7 years ago

News and Report7 years ago

Society4 years ago

Society4 years ago

News and Report6 years ago

News and Report6 years ago