...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

FULL DETAILS OF HOW THE BANK FRAUDULENTLY SOLD DESEASED CUSTOMERS PROPERTY AND DISOBEYED COURT ORDER TO PRODUCE CUSTOMER’S BANK STATEMENT

Justice Ibironke Harrison of a Lagos High Court in Tafawa Balewa Square has held that Union Bank perpetrated monumental fraud in the selling of a property owned by the late Otunba Adedoyin Olayide Ogunde, to offset a loan debt.

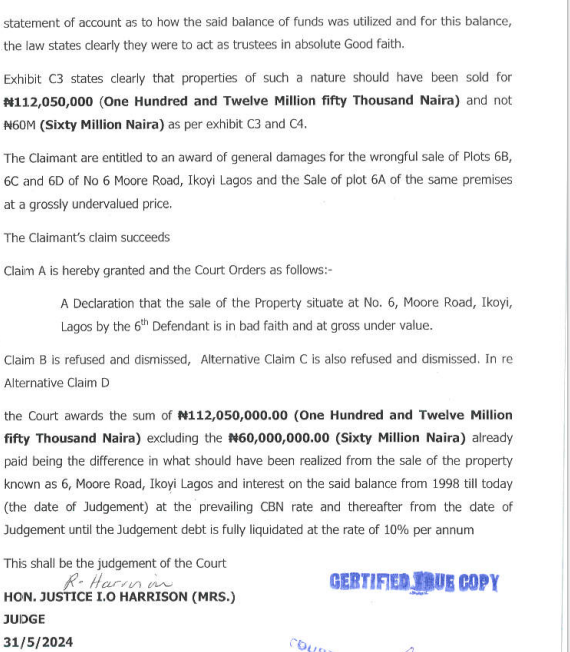

In the judgement delivered after 25 years of legal tussle, Justice Harrison found out that the sale of late Ogunde’s property situated at old Ikoyi, Lagos, by Union Bank to offset a loan facility by the deceased was conducted in bad faith and at a significantly undervalued price.

The judge found out that the property worth N142 million was ridiculously sold by Union bank at N30 million.

According to Justice Harrison, the mere fact that Ogunde defaulted in repaying the loan was no valid excuse for the bank to fling his property at ridiculous rates simply for the purpose of realising the debt owed; and doing so at a price that is so low is evidence of fraud.

“The only obligation incumbent on a mortgagee under a power of sale of his mortgage is that he should act in good faith. The court will always be on the lookout that the mortgagee acts bonafide and observes reasonable precautions to obtain not the best price, but a proper price.

“By the sale of Plot 6A, the bank had fully realised its money and had some balance to remit to the family. Without remitting the balance, it went ahead to sell the rest of the buildings.

“By going against what it had told Ogunde’s personal representatives on the partition of the property, the Bank’s action smacks of fraud, collusion and definitely does not show good faith.

“Union Bank further failed accountability principles when it withheld vital documents, including the deceased’s statement of account, from the court, showing that those documents, if produced, could have impacted negatively on the bank”, the judge ruled.

In her judgement, Justice Harrison held that Union Bank failed to act in good faith in discharging its duties as a trustee for the deceased’s estate, as the sale of the property was conducted privately rather than by auction as instructed.

Justice Harrison noted that the property, comprising nine luxurious flats and additional plots, was sold for N30 million by the bank has fully covered the deceased’s outstanding debt of over N14 million.

“Further sales of additional plots for N30 million each were also undervalued. There was also lack of transparency regarding the balance utilization after settling the debt, suggesting fraud and collusion. While the sales could not be overturned due to insufficient direct evidence of collusion by buyers, the claimants were entitled to damages”, the judge further held.

Consequently, Justice Harrison ordered the bank to pay N112 million to the children of the deceased. The court also ordered interest payment on the money from 1998 until the judgment date at the prevailing Central Bank of Nigeria rate, and 10 per cent per annum from the judgment date until full payment.

Going by this court’s directive, the bank is liable to pay more than N10.5 billion as at 2024. .

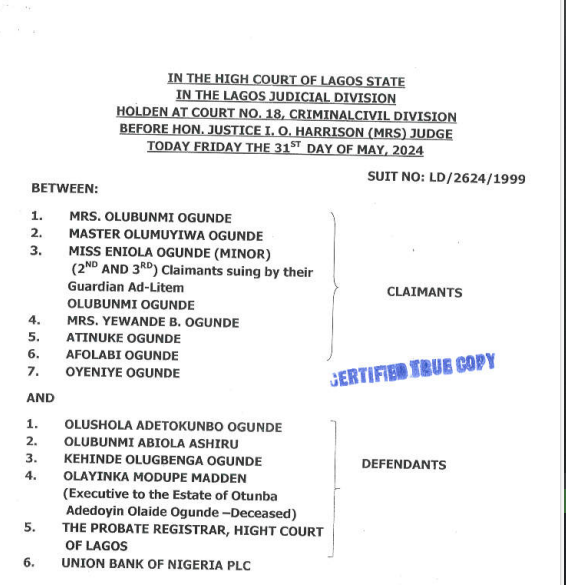

The claimants in the suit marked LD/2624/1999 are the children of the deceased, while Olushola Ogunde, Olubunmi Ashiru, Kehinde Ogunde, Olayinka Madden (executor of Ogunde’s estate), the Probate Registrar of the Lagos High Court, and Union Bank of Nigeria were joined as co-defendants as 1st to 6th defendants in the suit.

In the suit, the Ogunde family contended that the sale and the processes relied on by the bank to dispose of their benefactor’s property was characterised by fraud and collusion.

The family further argued that the assets were of a higher value than what the bank placed on it, and that there was a collusion between the bank and the purchasers.

Union Bank opposed an amendment to the claimants’ statement, arguing it was statute-barred. However, in May 2017, Justice Morenike Obadina dismissed this objection, allowing the amendment.

In the suit, the claimants are seeking among others, a declaration that granting of Probate by the 5th defendant of the last Will and Testament of Otunba Adedoyin Olayide Ogunde (deceased) dated 2nd August, 1995 on the 17th of November, 1997 to the 1st to 4th defendants as executors is wrongful, null and void, the same being inconsistent with the provisions and intendment of the Will as made by the Testator.

They were also seeking an order of injunction restraining the 6th defendant, its servants, agents, privies, assigns or any other person acting for it from disbursing, dissipating or otherwise part with the possession of the balance due to the Estate of Otunba Adedoyin Olayide Ogunde (deceased) on the sale of 6, Moore Road, Ikoyi, Lagos, pursuant to the legal mortgage in that respect to any person until the final determination of this suit.

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)