...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

The River Niger boat disaster which claimed over 100 lives along Patigi Local Government Area of Kwara state on Monday 12th June, 2023 and the flooding incident that submerged over 116 houses in the popular Trademore estate in Abuja on Friday June 23, 2023 have thrown into sharp relief the need for proactive disaster prevention and management especially as the rainy season intensifies.

As a corollary these incidents have also underlined the imperative of the National Emergency Management Agency (NEMA) which is charged with disaster management in Nigeria.

Established via Act 12 as amended by Act 50 of 1999, to manage disasters, NEMA spells out its mission on its website as having been set up to “coordinate resource towards efficient and effective disaster prevention, preparation, mitigation and response in Nigeria”

The agency cites its vision as “to build a culture of preparedness, prevention, response and community resilience to disaster in Nigeria.”

NEMA has become a household name since the insurgency began roiling the North East over a decade ago and we began witnessing rising incidents of flooding and sundry natural disasters exacerbated by climate change and climate variability.

On Wednesday June 21, 2023, the Director General of NEMA, MUSTAPHA HABIB AHMED flagged off what the agency described as “the downscaling of disaster early warning measures to grassroots for effective live-saving early actions during the 2023 rainy season.”

The proactive awareness creation programme expected to impact all states in the country is predicated upon what the DG described as “NEMA’s paradigm shift towards disaster risk reduction and to take disaster risk management to the grassroots.”

Proactivity, prevention and mitigation are key words in the message NEMA is sending out and the messages are targeted at subnational level actors – states and local governments and communities – because as NEMA has noted disasters are often local and subnational level actors are usually the first line responders when they occur.

NEMA is able to offer proactive warning and prevention strategies because technological advances have made it easier to make forecasts and predict weather patterns and behavior, a fact the DG reiterated during his visit to Akwa Ibom state.

Ahmed in his speech at the event noted that “we can only achieve this through the deployment of scientific information in form of impact based predictions that constitute the foundation of early warning advisories and disaster risk mapping to be delivered to end users in disaster management and development planning.”

Early in the year, the Nigerian Meteorological Agency (NIMET) and the Nigerian Hydrological Services Agency (NIHSA) released their 2023 Seasonal Climate Prediction (SCP) and Annual Flood Outlook (AFO) respectively.

According to NiMET’s forecast published in January, Nigerians should prepare for “early onset of rainfall accompanied by flooding,” with torrential rains expected in the “coastal areas in the south-south, particularly Bayelsa, Akwa Ibom and Rivers.”

NIHSA in its 2023 Annual Flood Outlook (AFO), with the theme “Flood Prediction and its Impact on Socio-Economic Livelihood of Nigerians” warned that 178 Local Government Areas (LGA’s) in 32 States of the federation and the FCT fall within the Highly Probable Flood Risks Areas.”

NEMA has, in response to these dire prognostications, embarked on its awareness and mitigation campaign as Ahmed noted in Uyo. “It is on this premise that NEMA drawing from its mandate of disaster risk management decided to take the initiative of partnering with NIHSA and NiMet to downscale early warning alerts to States, Local Government Authorities and communities at risk of flood disaster and associated hazards.”

But why the choice of Uyo as flag-off point? The DG of NEMA explained that it was on account of what he described as “the existing mutual support and collaboration between NEMA and the Akwa Ibom government,” where NEMA has set up an operations office with a promise from the state government of “office accommodation and warehouse facility to enable the prepositioning and stockpiling of relief items for easy deployment in the event of an emergency.”

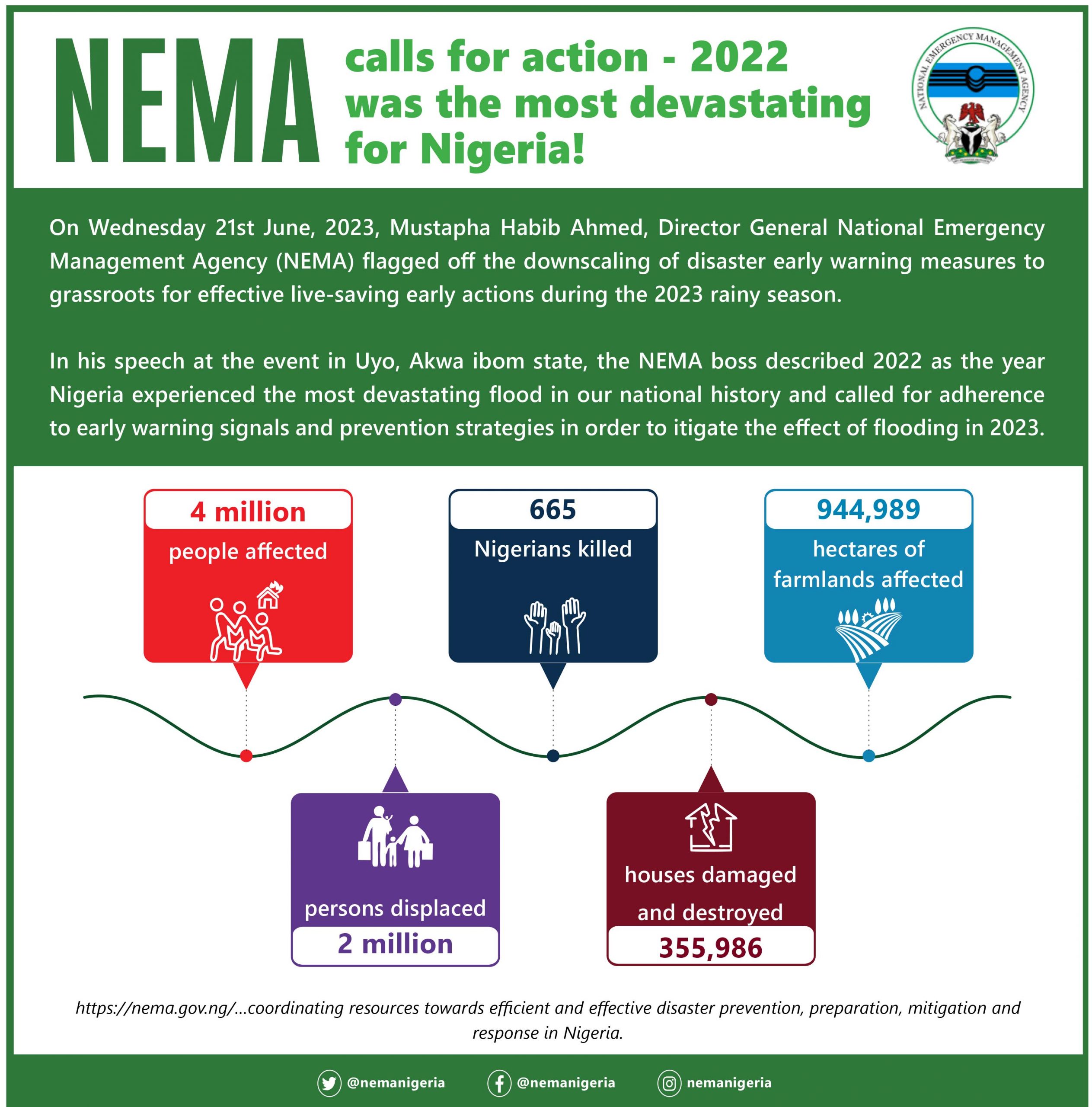

The ongoing downscaling of disaster early warning measures is also important in consideration of the fact that Nigeria was severely impacted by flooding in 2022 which NEMA has described as the year in which the country experienced the most devastating Impact of flooding since record keeping began.

Flooding affected over 4 million Nigerians last year, killed 665 and displaced over 2 million persons, caused damage and destruction to about 355,986 houses and 944,989 hectares of farmlands.

The breathtaking scale of death and destruction is at the core of NEMA’s proactive measures with a focus on four key areas – Preparedness, Mitigation, Response and Recovery.

While preparedness and Mitigation can be directed centrally through the deployment of credible information and development of the right plans, Response and Recovery require intervention at the subnational levels because disasters often happen in local communities which means that first responders are often from within the state or local government.

NEMA as part of its downscaling measures is supporting capacity building efforts as well as funding and provision of equipment to upskill Local Emergency Management Committees (LEMCs) to equip them and make them ready to “take disaster risk management to the communities to build safe and resilient communities and by extension a safer and resilient Nigeria.”

The rains are here, the message is going out and one hopes that by the time we take stock at the end of the year, the toll would be nowhere near as devastating as it was in 2022 thanks to NEMA’s proactive activities.

– Toni Kan , writer and PR and Developmental expert writes from London

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)