...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

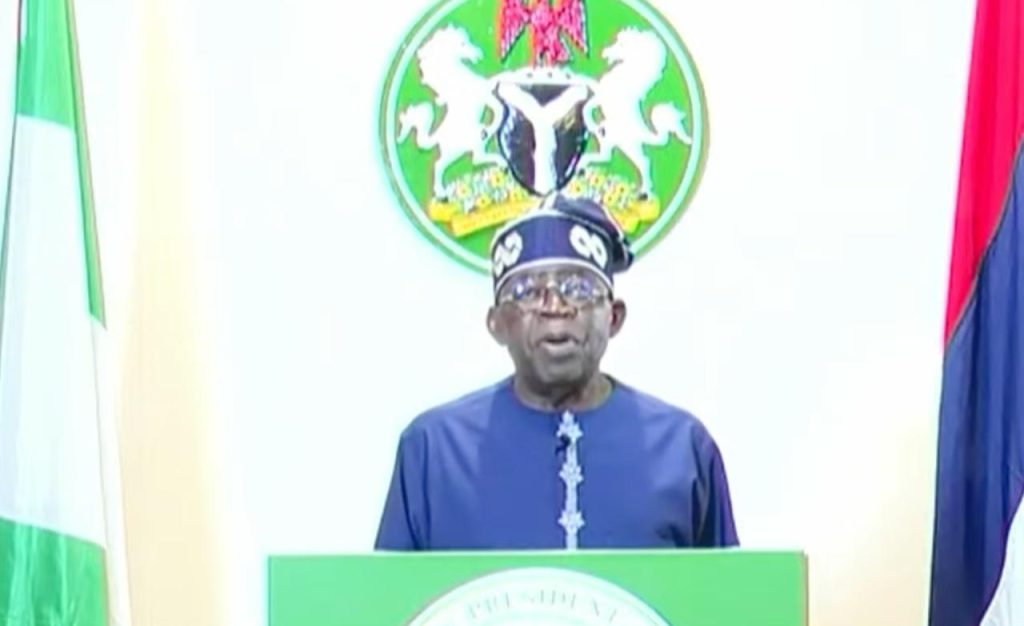

My fellow Nigerians,

1. I speak to you today with a heavy heart and a sense of responsibility, aware of the turmoil and violent protests unleashed in some of our states.

2. Notably among the protesters were young Nigerians who desired a better and more progressive country where their dreams, hopes, and personal aspirations would be fulfilled.

3. I am especially pained by the loss of lives in Borno, Jigawa, Kano, Kaduna and other states, the destruction of public facilities in some states, and the wanton looting of supermarkets and shops, contrary to the promise of protest organisers that the protest would be peaceful across the country. The destruction of properties sets us back as a nation, as scarce resources will be again used to restore them.

4. I commiserate with the families and relations of those who have died in the protests. We must stop further bloodshed, violence and destruction.

5. As President of this country, I must ensure public order. In line with my constitutional oath to protect the lives and property of every citizen, our government will not stand idly by and allow a few with a clear political agenda to tear this nation apart.

6. Under the circumstances, I hereby enjoin protesters and the organisers to suspend any further protest and create room for dialogue, which I have always acceded to at the slightest opportunity. Nigeria requires all hands on deck and needs us all – regardless of age, party, tribe, religion or other divides, to work together in reshaping our destiny as a nation. To those who have taken undue advantage of this situation to threaten any section of this country, be warned: The law will catch up with you. There is no place for ethnic bigotry or such threats in the Nigeria we seek to build.

7. Our democracy progresses when the constitutional rights of every Nigerian are respected and protected. Our law enforcement agencies should continue to ensure the full protection of lives and properties of innocent citizens in a responsible manner.

8. My vision for our country is one of a just and prosperous nation where each person may enjoy the peace, freedom, and meaningful livelihood that only democratic good governance can provide – one that is open, transparent and accountable to the Nigerian people.

9. For decades, our economy has remained anaemic and taken a dip because of many misalignments that have stunted our growth. Just over a year ago, our dear country, Nigeria, reached a point where we couldn’t afford to continue the use of temporary solutions to solve long-term problems for the sake of now and our unborn generations. I therefore took the painful yet necessary decision to remove fuel subsidies and abolish multiple foreign exchange systems which had constituted a noose around the economic jugular of our Nation and impeded our economic development and progress.

10. These actions blocked the greed and the profits that smugglers and rent-seekers made. They also blocked the undue subsidies we had extended to our neighbouring countries to the detriment of our people, rendering our economy prostrate. These decisions I made were necessary if we must reverse the decades of economic mismanagement that didn’t serve us well. Yes, I agree, the buck stops on my table. But I can assure you that I am focused fully on delivering the governance to the people – good governance for that matter.

11. In the past 14 months, our government has made significant strides in rebuilding the foundation of our economy to carry us into a future of plenty and abundance. On the fiscal side, aggregate government revenues have more than doubled, hitting over 9.1 trillion Naira in the first half of 2024 compared to the first half of 2023 due to our efforts at blocking leakages, introducing automation, and mobilising funding creatively without additional burden on the people. Productivity is gradually increasing in the non-oil sector, reaching new levels and taking advantage of the opportunities in the current economic ambience

12. My dear brothers and sisters, we have come this far. Coming from a place where our country spent 97% of all our revenue on debt service; we have been able to reduce that to 68% in the last 13 months. We have also cleared legitimate outstanding foreign exchange obligations of about $5billion without any adverse impact on our programmes.

13. This has given us more financial freedom and the room to spend more money on you, our citizens, to fund essential social services like education and healthcare. It has also led to our State, and Local Governments receiving the highest allocations ever in our country’s history from the Federation Account.

14. We have also embarked on major infrastructure projects across the country. We are working to complete inherited projects critical to our economic prosperity, including roads, bridges, railways, power, and oil and gas developments. Notably, the Lagos-Calabar Coastal Highway and Sokoto-Badagry Highway projects will open up 16 connecting states, creating thousands of jobs and boosting economic output through trade, tourism and cultural integration

15. Our once-declining oil and gas industry is experiencing a resurgence on the back of the reforms I announced in May 2024 to address the gaps in the Petroleum Industry Act. Last month, we increased our oil production to 1.61million barrels per day, and our gas assets are receiving the attention they deserve. Investors are coming back, and we have already seen two Foreign Direct Investments signed of over half a billion dollars since then.

16. Fellow Nigerians, we are a country blessed with both oil and gas resources, but we met a country that had been dependent solely on oil-based petrol, neglecting its gas resources to power the economy. We were also using our hard-earned foreign exchange to pay for, and subsidise its use. To address this, we immediately launched our Compressed Natural Gas Initiative (CNG) to power our transportation economy and bring costs down. This will save over two trillion Naira a month, being used to import PMS and AGO and free up our resources for more investment in healthcare and education.

17. To this end, we will be distributing a million kits of extremely low or no cost to commercial vehicles that transport people and goods and who currently consume 80% of the imported PMS and AGO.

18. We have started the distribution of conversion kits and setting up of conversion centres across the country in conjunction with the private sector. We believe that this CNG initiative will reduce transportation costs by approximately 60 per cent and help to curb inflation.

19. Our administration has shown its commitment to the youth by setting up the student loan scheme. To date, 45.6billion Naira has already been processed for payment to students and their respective institutions

20. I encourage more of our vibrant youth population to take advantage of this opportunity. We established the Consumer Credit Corporation with over N200billion to help Nigerians to acquire essential products without the need for immediate cash payments, making life easier for millions of households. This will consequently reduce corruption and eliminate cash and opaque transactions. This week, I ordered the release of an additional N50billion Naira each for NELFUND – the student loan, and Credit Corporation from the proceeds of crime recovered by the EFCC

21. Additionally, we have secured $620million under the Digital and Creative Enterprises (IDiCE) – a programme to empower our young people, creating millions of IT and technical jobs that will make them globally competitive. These programmes include the 3Million Technical Talents scheme. Unfortunately, one of the digital centres was vandalised during the protests in Kano. What a shame!

22. In addition, we have introduced the Skill-Up Artisans Programme (SUPA); the Nigerian Youth Academy (NIYA); and the National Youth Talent Export Programme (NATEP).

23. Also, more than N570 billion has been released to the 36 states to expand livelihood support to their citizens, while 600,000 nano-businesses have benefitted from our nano-grants. An additional 400,000 more nano-businesses are expected to benefit.

24. Furthermore, 75,000 beneficiaries have been processed to receive our N1million Micro and Small Business single-digit interest loans, starting this month. We have also built 10 MSME hubs within the past year, created 240,000 jobs through them and 5 more hubs are in progress which will be ready by October this year.

25. Payments of N1billion each are also being made to large manufacturers under our single-digit loans to boost manufacturing output and stimulate growth.

26. I signed the National Minimum Wage into law last week, and the lowest-earning workers will now earn at least N70,000 a month.

27. Six months ago in Karsana, Abuja, I inaugurated the first phase of our ambitious housing initiative, the Renewed Hope City and Estate. This project is the first of six we have planned across the nation’s geopolitical zones. Each of these cities will include a minimum of 1,000 housing units, with Karsana itself set to deliver 3,212 units

28. In addition to these city projects, we are also launching the Renewed Hope Estates in every state, each comprising 500 housing units. Our goal is to complete a total of 100,000 housing units over the next three years. This initiative is not only about providing homes but also about creating thousands of jobs across the nation as well as stimulating economic growth.

29. We are providing incentives to farmers to increase food production at affordable prices. I have directed that tariffs and other import duties should be removed on rice, wheat, maize, sorghum, drugs, and other pharmaceutical and medical supplies for the next 6 months, in the first instance, to help drive down the prices.

30. I have been meeting with our Governors and key Ministers to accelerate food production. We have distributed fertilisers. Our target is to cultivate more than 10 million hectares of land to grow what we eat. The Federal Government will provide all necessary incentives for this initiative, whilst the states provide the land, which will put millions of our people to work and further increase food production. In the past few months, we have also ordered mechanized farming equipment such as tractors and planters, worth billions of Naira from the United States, Belarus, and Brazil. I can confirm to you that the equipment is on the way

31. My dear Nigerians, especially our youth, I have heard you loud and clear. I understand the pain and frustration that drive these protests, and I want to assure you that our government is committed to listening and addressing the concerns of our citizens.

32. But we must not let violence and destruction tear our nation apart. We must work together to build a brighter future, where every Nigerian can live with dignity and prosperity.

33. The task before us is a collective one, and I am leading the charge as your President. A lot of work has gone into stabilising our economy and I must stay focused on ensuring that the benefits reach every single Nigerian as promised.

34. My administration is working very hard to improve and expand our national infrastructure and create more opportunities for our young people.

35. Let nobody misinform and miseducate you about your country or tell you that your government does not care about you. Although there have been many dashed hopes in the past, we are in a new era of Renewed Hope. We are working hard for you, and the results will soon be visible and concrete for everyone to see, feel, and enjoy.

36. Let us work together to build a brighter future for ourselves and for generations to come. Let us choose hope over fear, unity over division, and progress over stagnation. The economy is recovering; Please, don’t shut out its oxygen. Now that we have been enjoying democratic governance for 25 years, do not let the enemies of democracy use you to promote an unconstitutional agenda that will set us back on our democratic journey. FORWARD EVER, BACKWARD NEVER!

37. In conclusion, security operatives should continue to maintain peace, law, and order in our country following the necessary conventions on human rights, to which Nigeria is a signatory. The safety and security of all Nigerians are paramount.

38. Thank God — and Thank you for your attention, and may God continue to bless our great Nation. Thank you very much.

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)