FBN shareholders have demanded EGM under CAMA, aiming to remove Chairman Femi Otedola and non-executive director Julius Omodayo-Owotuga.

A group of shareholders at the First Bank of Nigeria Holdings Plc., with 10 per cent of the company’s shares, on Wednesday, formerly requested the company to call an Extra-ordinary General Meeting (EGM) under section 215 (1) of CAMA in which case they have 21 days to call the EGM.

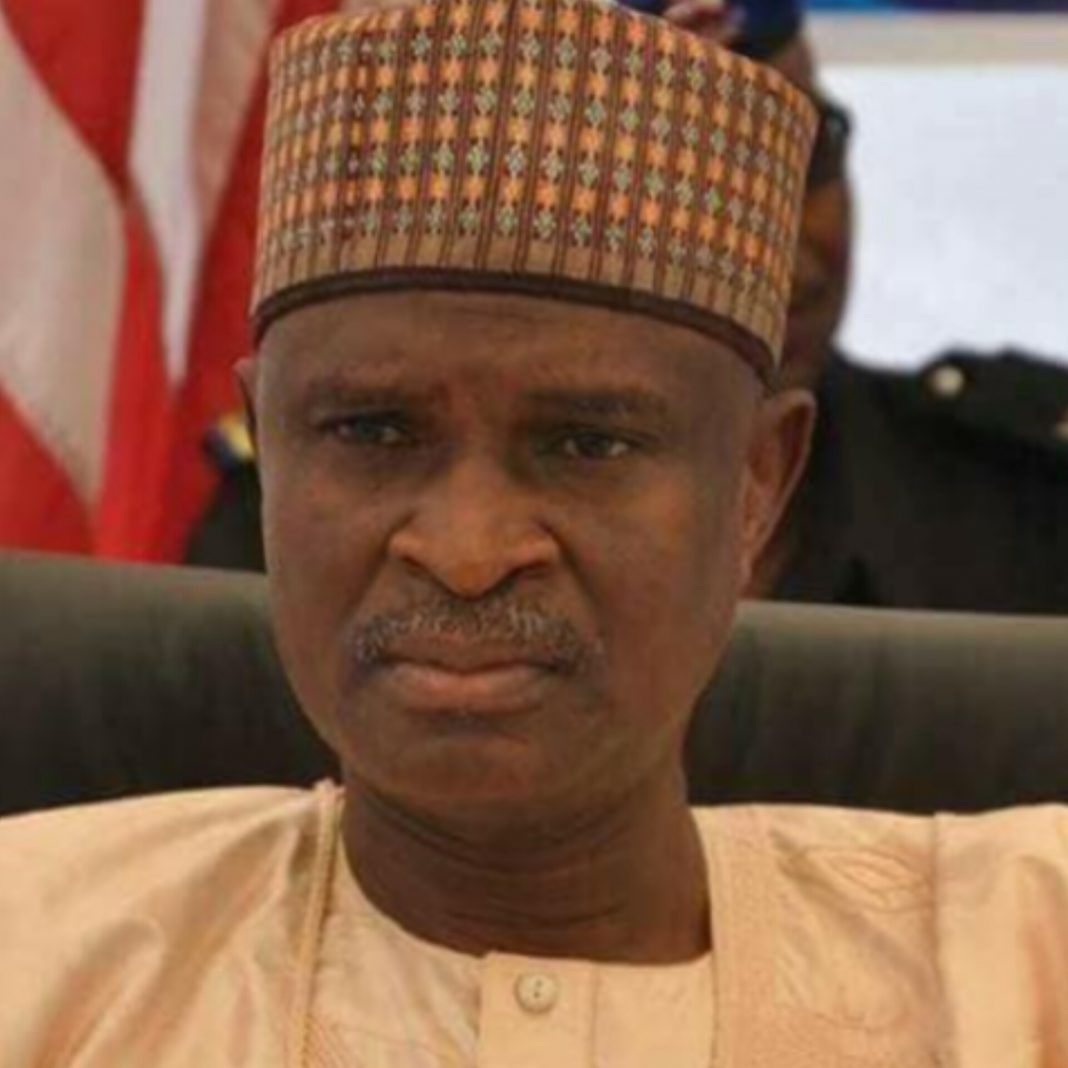

Top on the agenda of the proposed meeting is the removal of FBN Chairman, Mr. Femi Otedola and a Non-executive/Deputy Chief Executive of Geregu Power Plc, Mr. Julius B. Omodayo-Owotuga.

The shareholders alleged that since a former Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, influenced Otedola’s acquisition of significant amount of shares that led to his emergence as Chairman of FBN Holdings, the financial institution has not known peace.

The former CBN governor, shareholders say, had invited the former Chief Executive Officer of FirstBank, Dr. Adesola Adeduntan, to his house in Ikoyi and told him to work with Otedola to help him take over the bank. Which he dutifully did, and subsequently paved the way for Otedola becoming a non-Executive in the first instance, without security clearance from the Department of State Security, DSS and the Economic and Financial Crimes Commission, EFCC.

However, having successfully taken over the bank, the first person Otedola targeted to be kicked out was Adeduntan himself, followed by Tunde Hassan-Odukale, who was the Chairman of First Bank of Nigeria Limited, and subsequently moved against Tosin Adewuyi, whom he side-stepped for the position of CEO despite coming first in the interview conducted by a global recruitment agency.

Instead, he saw to the appointment of the man who came last in the interview, Mr Olusegun Alebiosu. Mr Alebiosu was said to have since pledged “absolute loyalty” to Otedola and has allowed him to use another of his personal acolyte, a non-Executive Director, Akin Akinfemiwa, to run the bank.

According to the shareholders, with Otedola as Chairman, his personal staff, Omodayo-Owotuga at the Holdco, and yet another personal staff at the bank, Otedola has seized full control of the bank and does as he pleases.

Thus, with the private placement of N360 billion shares, other shareholders fear he would clearly have absolute control and could turn First Bank to his piggy bank without checks, balances and corporate governance.

But for Emefiele, who handed him the bank, the other shareholders contended that, Otedola could not have passed the fit and proper test, having ruined several banks with non-performing loans, which were then sold to AMCON before he got his “sweetheart deal” under former President Goodluck Jonathan and Godwin Emefiele

After ousting Adeduntan, Tosin Adewuyi, an Executive Director would follow and next was a Group Head, Folake Ani-Mumuney, whose only offence was that she carried out a directive of the board to host a sendforth party for the retiring CEO, who had been at the helm of affairs in the bank for nine years.

He had earlier removed Ms. Ijeoma Nwogwugwu, a noted journalist, as a non-executive director of a First Bank subsidiary for daring to write a critically acclaimed article, which he considered unfavourable to his ego.

Now, the question being asked is; what is the business of a non-Executive Chairman of a HoldCo sacking a group head of a bank, who simply obeyed the instructions of the Managing Director and the Board of the Bank?

THISDAY gathered that Otedola has already been granted a loan of about $45 to 50 million by the African Export-Import Bank (Afreximbank), which comes to about N90 billion

“This is to enable him (Otedola) take full control during the proposed N360 billion private placement. But some of the shareholders are saying instead of a private placement for shares of the bank, it should be by right issue or public offer,” a source claimed.

However, Otedola’s preference for private placement is seen as a ploy to gain control and run the financial institution as his private estate, a source, who pleaded to remain anonymous, further alleged.

FBN Holdings has been a subject of battle over who holds the single largest share of the institution.

First Bank Holdings, in its audited accounts for 2023, had put Otedola as the single largest shareholder with a 9.41 per cent stake in the financial institution. Otedola, however, has recently increased his share holding by massive acquisition of more shares. At the moment, his exact stake is unclear.

But data from the Central Securities Clearing System (CSCS), the widely accepted source for confirming share ownership, has Barbican Capital, which is affiliated with the Oba Otudeko-owned Honeywell Group, as the largest single shareholder with a 15.01 per cent stake.

Records kept by the bank’s registrars, Meristem Registrars & Probate Services Ltd, also showed that Barbican Capital is the single largest shareholder with 5,386,397,202 shares (5.38 billion) shares as of May 23, 2024.

Barbican Capital had sued FBN Holdings for wrongly stating its shareholding in its audited financial statement.

First Bank recently laid off about 100 senior staff members in a major organisational shakeup.

Reports had indicated that the bank’s top executives were asked to leave — as part of its corporate restructuring and repositioning plan for 2025 — following the confirmation of Olusegun Alebiosu as FBN’s managing director (MD) and chief executive officer (CEO) in June last year.

There were also allegations that the exits were part of a concerted effort by Otedola to introduce new hands into several leadership positions in the bank.

It is not clear what Security and Exchange Commission, SEC and the Central Bank of Nigeria, CBN would do in the wake of this CAMA induced demand for an EGM called to remove Otedola and stop the private placement of the bank shares.

ARISE TV / THISDAY NEWSPAPER

Society6 years ago

Society6 years ago

Society4 years ago

Society4 years ago

News and Report6 years ago

News and Report6 years ago

Society4 years ago

Society4 years ago

News and Report7 years ago

News and Report7 years ago

News and Report6 years ago

News and Report6 years ago

Notice: Undefined variable: user_ID in /home/societyr/public_html/societyreporters.com/wp-content/themes/zox-news/comments.php on line 48

You must be logged in to post a comment Login